Vietnam needs to consider more ambitious tax reform: WB

The declining trend in revenue collection is a source of concern as it has serious consequences for the fiscal policy conducted by the government, especially on its investment program.

In the longer run, the Vietnamese government needs to consider a more ambitious tax reform program as part of its new national strategy for 2021–2030 as tax effort has been on the decline, according to the World Bank.

The reform strategy would guide the next phase of tax reforms to reverse the declining tax effort and stabilize it over the medium term, while attaining the desirable features of a good tax system, the bank said in its latest semi-annual Taking Stock report.

Vietnam should use the process to widely discuss key reform initiatives, such as rebalancing the tax mix for better growth and equity, considering the introduction of new tax instruments such as a property tax, and modernization of tax administration, including institutional reform, comprehensive compliance risk management, and further digitalization, the bank suggested.

Meanwhile, in the short term, the government can continue to focus its attention on closing loopholes in the existing tax system. For example, the recent adoption of Decree 20 should help protect Vietnam against profit shifting by multinational firms, even though further clarification is needed over the application of the rules.

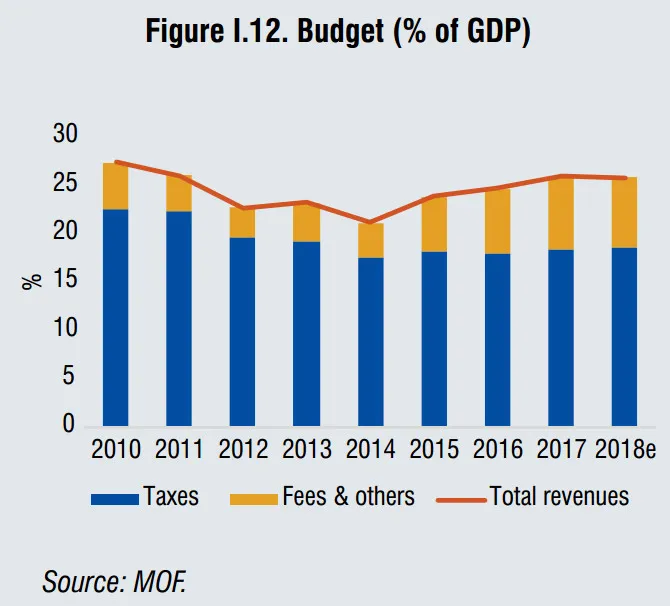

The recommendations are made in the context that over the past decade, Vietnam’s tax effort has declined from 23% of GDP in 2010 to about 18% of GDP in 2018, even if a small rebound has occurred since 2015.

| World Bank, Taking Stock report, December 2019 |

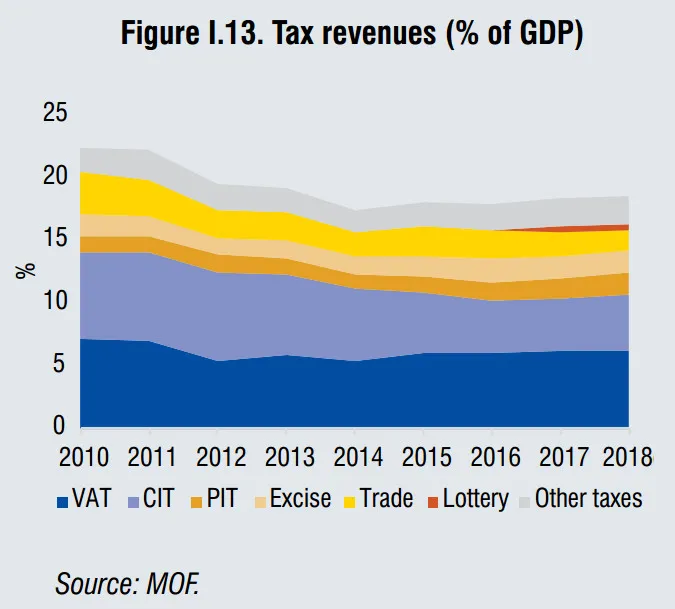

This decline has resulted from the combination of lower trade tax revenue, mostly customs duties (due to Vietnam’s international commitments), and declining revenue from the corporate income tax, as the government reduced the statutory rate with the aim of stimulating the economy.

| World Bank, Taking Stock report, December 2019 |

If an increase in non-tax revenue has enabled the government to collect more revenue since 2015, this has been mainly the result of one-time transactions such as sales of land user rights, sales of state-owned houses, and dividends from and divestment of state-owned enterprises. It is also explained by the reclassification since 2017 of the revenue from the lottery as tax revenue, which contributed to the increase in tax revenue (0.6% and 0.5% of GDP in 2017 and 2018, respectively).

The declining trend in revenue collection is a source of concern as it has serious consequences for the fiscal policy conducted by the government, especially on its investment program. Unless the authorities opt to borrow more, additional domestic revenue will be needed to meet the country’s ambitious targets in terms of infrastructure and social developments, the bank said in the report.