Vietnam parliament approves state budget deficit of 3.44% of GDP for 2020

The National Assembly agreed on allocating VND115.4 trillion (US$4.97 billion) for debt payment and VND220 trillion (US$9.47 billion) for development investment.

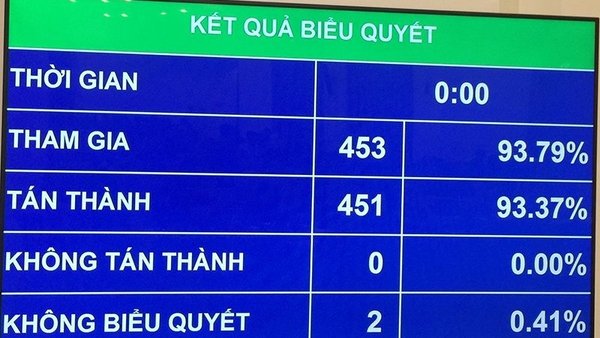

The National Assembly, Vietnam’s supreme legislative body, today approved a resolution on state budget estimate for 2020, including the state budget deficit of VND234.8 trillion (US$10.11 billion, with an endorsement from 451 out of 453 of National Assembly deputies present, representing an approval ratio of 93.37%.

| The resolution received an endorsement from 451 out of 453 of National Assembly deputies present, representing an approval ratio of 93.37%. |

Upon breaking down, the state budget revenue for 2020 is estimated at VND1,521 trillion (US$74.54 billion), including estimated central state budget revenue of VND851.76 trillion (US$36.7 billion) and provincial budget revenue of VND660.53 trillion (US$28.46 billion),

Meanwhile, state budget expenditure is expected to reach VND1,747.1 trillion (US$75.29 billion), with the central budget expenditures of VND1,069.56 trillion (US$46.08 billion).

The National Assembly agreed on allocating VND115.4 trillion (US$4.97 billion) for debt payment, VND220 trillion (US$9.47 billion) for development investment, and VND55 trillion (US$2.37 billion) on administration costs of state and party agencies, organizations, among others.

Additionally, an amount of VND14.6 trillion (US$629.15 million) would be allocated for wage reform and laying off public employees.

In a discussion session, Nguyen Duc Hai, chairman of the Finance- Budget Committee under the National Assembly, expressed concern over slow disbursement progress of public investment funds, going down from 64.8% of disbursement rate in 2015 to 54.5% in 2016, 53.1% in 2017, 50.9% in 2018 and 49.1% as of late October in 2019.

On this issue, the Standing Committee of the National Assembly requested the government to review the disbursement procedures to address bottlenecks during the process, ensuring greater disbursement rate and efficiency in utilizing public investment funds.

The Standing Committee urged a more severe discipline measure to organizations and individuals that are directly involved in the delay in announcing public investment plan and the disbursement process.

Previously, the Finance – Budget Committee said with the disbursement rate of 49.1% to date, it would be difficult for the government to meet the disbursement target by the year-end.

The Finance – Budget Committee attributed the lack of preparation for investment projects, difficulties in site clearance and delay in allocating public funds, among others, to such slow disbursement progress.

According to the committee, these issues have been known for many years, but there has been lack of efforts from government agencies to resolve them, and which require all concerned parties to strictly follow regulations and laws on finance – budget, including the Law on Public Investment.

Prime Minister Nguyen Xuan Phuc in a conference late September said slow disbursement of public investment are bottlenecks for the development of Vietnam’s economy and warned of major consequences if the issue is not properly addressed.

On November 11, the National Assembly approved Vietnam’s socio-economic development plan for 2020, including the GDP growth target of 6.8%.

In addition to the GDP growth target, the 2020 socio-economic development plan includes other key economic indicators, such as the consumer price index (CPI) to stay below 4%; export growth of 7%; ratio of trade deficit to total export value below 3%; total social investment capital at 33 – 34% of GDP; a decline by 1 – 1.5% in the poverty rate; unemployment rate in urban areas below 4%, among others.