Vietnam's positive growth in Q2 defies market expectations: HSBC

HSBC has raised its 2020 growth forecast for Vietnam to 3.0% from 1.6% previously, reflecting its renewed assumptions of Vietnam’s speedier economic rebound.

Despite mounting challenges, Vietnam’s GDP still registered positive growth of 0.4% year-on-year in the second quarter, defying market expectations for a contraction in its economic activity, according to HSBC.

Previously, HSBC forecast Vietnam’s economy to contract 2.9% in this quarter, while that of Bloomberg was -0.9%.

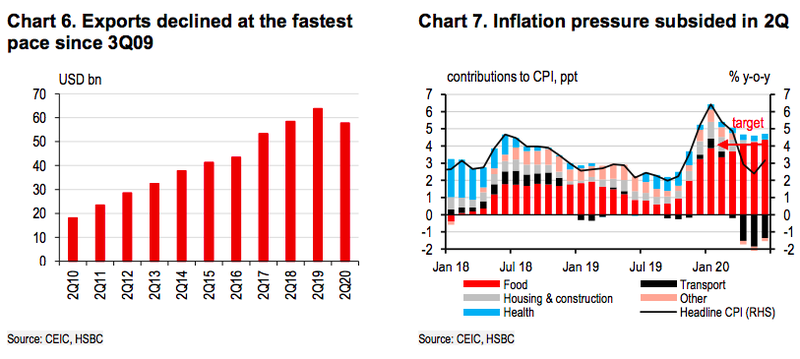

It is true that the country’s growth slowed to the lowest pace on record since quarterly GDP figures have been published, however, a surprisingly strong rebound in headline industrial production (+7.5% year-on-year) and a moderate fall in exports (-2%), prevented growth from falling into negative territory, stated HSBC.

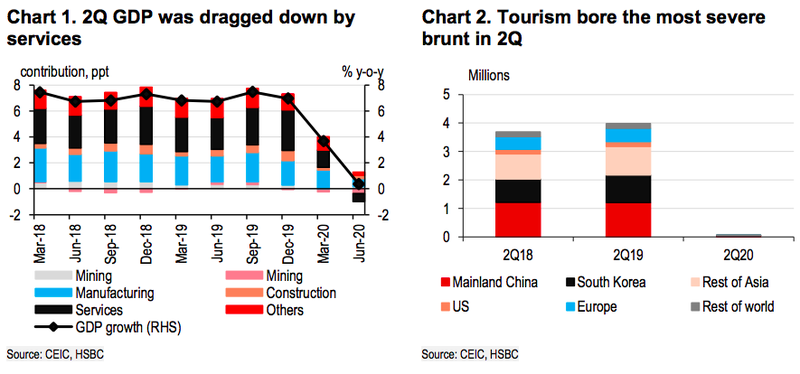

Unsurprisingly, the services sector was the biggest drag on the second quarter growth. After growing 7% year-on-year on average in recent years, it fell 1.8%, reflecting the compounded impact of border restrictions globally and the three-week nationwide lockdown in Vietnam.

After Vietnam announced restrictions on all foreigners entering the country (with a few exceptions) in late March, tourism was undoubtedly hit even harder, falling almost 100% year-on-year in the second quarter.

This is also evident in the GDP data: accommodation suffered a decline of close to 30% year-on-year while transport fell almost 5%, both falling at an even faster pace than the previous quarter. That said, not all services saw the same impact. Despite moderating from a fast expansion of almost 9% year-on-year in 2019, retail and wholesale still grew around 3%.

This may signal a stronger-than-expected recovery in domestic demand: retail sales rebounded strongly in May and June from April’s 20% year-on-year decline. In addition, domestic-facing industries, such as finance, education and ‘information & communication’, were resilient.

Meanwhile, the manufacturing sector held up better than anticipated. Unlike services, it registered growth of 3.2% year-on-year in the April-June period. This unexpected resilience is likely to be due to the upside surprise in June’s industrial production print. After two months of year-on-year contraction, industrial production recovered by 9.3%, with noticeable improvements in momentum of electronics-related production.

In addition, the June Manufacturing Purchasing Managers’ Index (PMI) jumped to 51.1, the first time it was above the 50- mark in five months. Key sub-indicators, such as output and new orders, rebounded strongly, signaling a continued improvement in the sector.

Outside of growth, Vietnam’s price pressures have gradually subsided due to the disinflationary forces of Covid-19. Headline inflation halved from 5.6% in the first quarter to 2.8% in this quarter, thanks to much lower oil prices.

That said, one thing that need to be mindful of from June’s CPI print is the still-elevated food prices. Food inflation grew 12% year-on-year in the second quarter, even faster than in the first quarter (+10%). Thus, taking into account high food inflation throughout the year, HSBC raised its 2020 inflation forecast to 3.3% from 2.7% previously.

That said, HSBC expected inflation pressures to be relatively subdued this year, below the State Bank of Vietnam (SBV)’s 4% inflation ceiling.

In short, despite Vietnam’s first half growth moderating significantly to 1.8% year-on-year from 7% in 2019, its economy is showing resilience. Thanks to its handling of the pandemic, the country is now on a steady recovery path quicker than it previously anticipated. Its external exposure to tech supply chains has offset some weakness in traditional manufacturing sectors, while domestic demand is rebounding faster than expected as the successful containment of the pandemic has so far been sustained well since the re-opening of the economy.

As a result, HSBC raised its 2020 growth forecast for Vietnam to 3.0% from 1.6% previously, reflecting its renewed assumptions of Vietnam’s speedier economic rebound. Given the stronger growth recovery and moderate inflation, HSBC does not expect a 50 basis-point cut by the SBV in the third quarter.