Vietnam stock market predicted to go sideways after strong performance in Sept

The price to earnings (P/E) of the benchmark VN-Index is not quite cheap to attract new inflows as it is 15.1x (as of 30 September) versus 14.5x – 15x in the pre-Covid time.

Vietnam’s stock market is predicted to go sideways in October following its strong rises in two previous months, which comes as a result of the continuous selling from foreign investors and the “Sell the news” reaction, according to Viet Dragon Securities Company (VDSC).

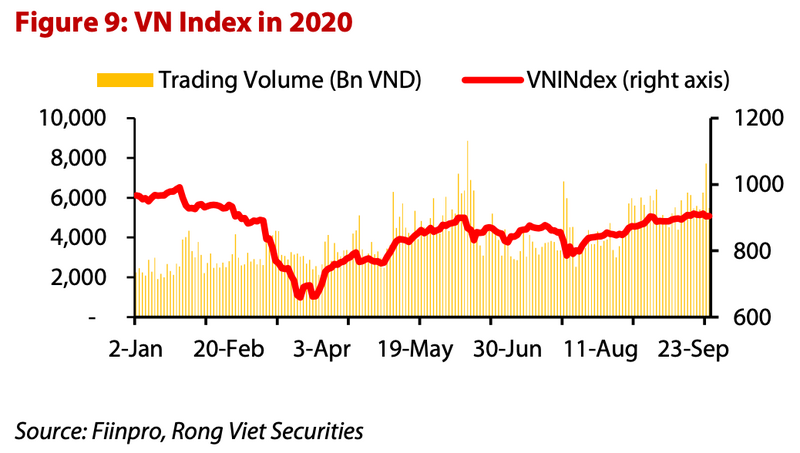

The benchmark VN-Index surpassed the 900-mark in early September and ended the month at 905, representing a 3% increase month-on-month and outperforming other regional indices for a second consecutive month, such as the Stock Exchange of Thailand (-6%), the Korea Stock Exchange Composite (0.1%), and S&P 500 (-4%).

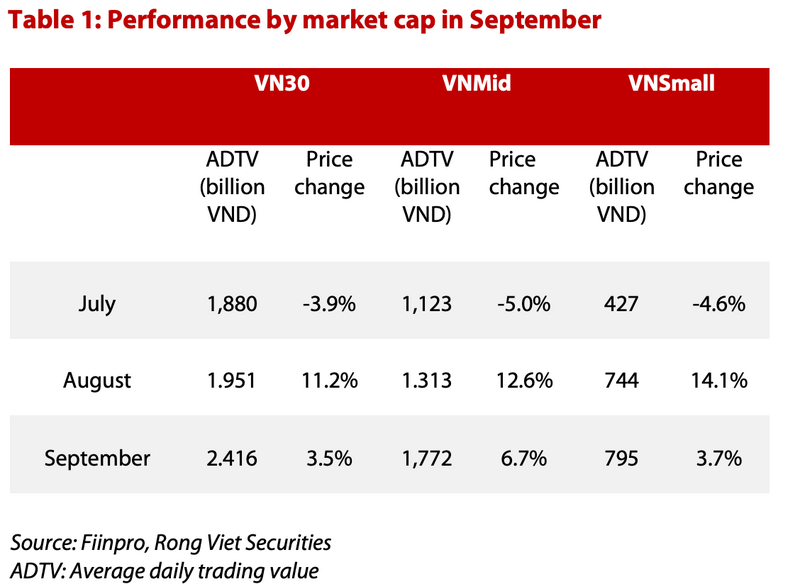

The daily average liquidity in the Ho Chi Minh City Stock Exchange (HOSE), home to the majority of large-caps, via matching order was VND5.5 trillion (US$236.68 million). Compared to July and August, this was a big jump with an increase of 47% and 28%, respectively.

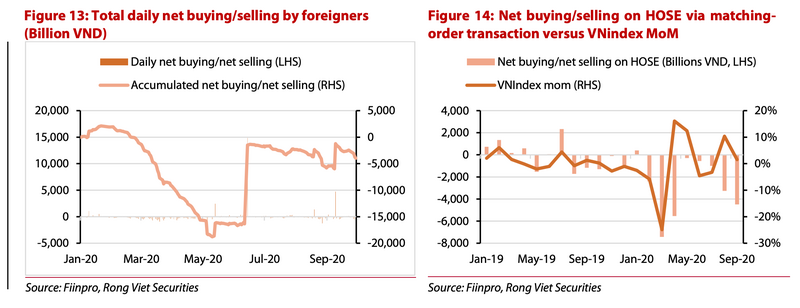

In September, foreign investors became net buyers on HOSE after two consecutive months of selling. However, the main inflows were from put-through transactions.

In terms of order-matching transactions, the upward move of the VN-Index did not stimulate foreign investors purchase. Specifically, they sold intensively to the tune of VND4.5 trillion (US$193.64 million), making September the largest net selling month in the last five months.

Coming to September, VDSC said the “Sell the news” reaction (stock trading based on just rumors) could create pressure on the VN-Index, as some stocks in the VN-30 Index (formed by the 30 largest and most liquid stocks) increased strongly in August and September, given rumors about decent business performance in the third quarter of 2020 or private placement to strategic shareholders, especially banks.

Recently, the State Bank of Vietnam (SBV), the country’s central bank, announced the decision to cut the policy rates. However, VDSC expected that it would not have a significant impact as some banks have already reduced interest rates and liquidity in the banking system remains abundant.

According to VDSC, Vietnam's 5-year credit default swaps (CDS) have seen upward moves recently, which indicates a higher probability of the VN-Index cooling off. Meanwhile, the price to earnings (P/E) of the VN-Index is not quite cheap to attract new inflows as it is 15.1x (as of 30 September) versus 14.5x – 15x in the pre-Covid time.

Another factor that has direct influence on Vietnam’s stock market is that of the US, but again, its complicated situation as a result of uncertainties surrounding the US presidential election make it hard to predict potential impacts on the VN-Index.

With all factors considered, the securities firm expected the market to fluctuate in the range from 865 – 920 for this month.