Vietnam’s healthcare benefit cost to grow 12.1% in 2020: Survey

The recent and on-going healthcare emergency caused by the Covid-19 also highlights the need to review how employers manage and deliver healthcare benefits.

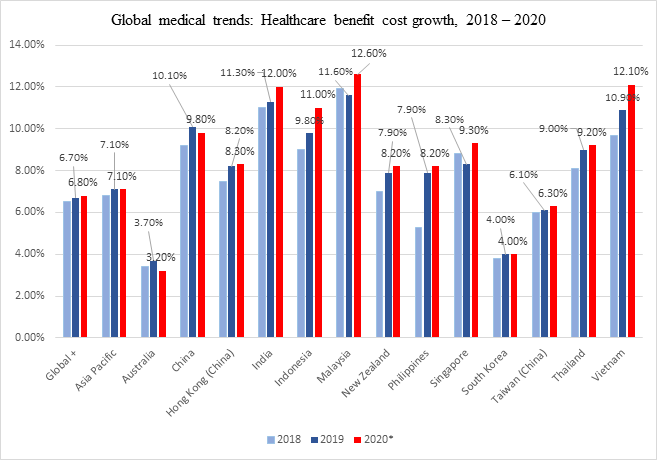

Growth in Vietnam’s healthcare benefit cost is predicted to increase 12.1% in 2020, higher than the 10.9% growth in 2019, according to a survey of medical insurers by Willis Towers Watson, a Singapore-based global advisory, broking and solutions company.

The projected growth rate in Vietnam is second only to Malaysia (at 12.6%) among surveyed markets, higher than the global average (6.8%) and the rate in Asia-Pacific (7.1%), according to the 2020 Global Medical Trends Survey, released on February 24.

*Projected +Global numbers exclude Venezuela |

The survey found medical insurers globally are projecting healthcare benefit costs to continue to rise across the world this year. In Asia Pacific, over one-third (35%) of the insurers expect that medical cost will continue to increase in the next three years.

According to the survey, employer-sponsored healthcare benefit costs are expected to grow at the same rate as last year in Asia Pacific at 7.1% in 2020. However, some markets including mainland China, Hong Kong (China), India, Indonesia, Malaysia and Singapore will exceed the average expected increase at 9.8%, 8.3%, 12%, 11%, 12.6% and 9.3% respectively.

“Controlling rising healthcare benefit costs remains a top priority for medical insurers and employers. Despite the regional variation in cost increases, they continue to outpace inflation and remain unsustainable, so neither insurers nor employers should be complacent,” said Cedric Luah, head of health and benefits, Asia and Australasia at Willis Towers Watson.

The recent and on-going healthcare emergency caused by the Covid-19 also highlights the need to review how employers manage and deliver healthcare benefits, not only in normal times, but also during crisis period like this.

While the impact on medical cost is still unknown for now, it is expected that cost will escalate this year, added Cedric. The renewed interest on telemedicine, extended medical leave and so on will potentially have an impact on cost and expenditure too. Therefore, it is important take a closer look at the factors driving up costs, and work out the cost containment measures, as well as contingency plans, as the outbreak continues.

When asked for the most significant cost-driving factors based on employee and provider behaviour, almost nine in 10 respondents (86%) cited the overuse of care by medical practitioners recommending too many services as the leading driver. At the same time 67% saw insured members overusing care which placed this as the second condition that pushed up costs. When asked about external factors (out of the control of both employees and providers), the high cost of new medical technology (71%), followed by providers’ profit motives (52%) once again emerged as the top two leading driver of medical costs. Both figures represent an increase from last year (60% and 37% respectively).

According to the survey, cancer (86%) and cardiovascular diseases (48%) will remain the top two conditions by cost and are expected to remain so in the near future. In addition, 60% of insurers are seeing an increase in incidences of gastrointestinal disorders.

Mental health, a “sleeper condition” where rates are quietly but steadily increasing

The survey also found mental health conditions are expected to become of the most significant cost factors over the next five years. Two-thirds (66%) of insurers expect that behavioral and mental health conditions will become one of the most costly medical conditions and form the bulk of medical expenses other than hospital and inpatient care in the next five years.

The potential impact of mental health conditions is getting the attention of insurers and employers all around the globe. While many insurers in Asia Pacific expect mental health disorders to become more prevalent in the next three years, about 50% are currently excluding them from standard medical insurance policy.

“Insurers in all regions are anticipating an increase in the demand for mental health services, and this will undoubtedly place upward pressure on costs and challenges to existing healthcare models. Employers should therefore move their focus beyond programs to broader organization factors that play a critical role in supporting mental and emotional wellbeing,” said Cedric.

The survey was conducted late last year reflecting the responses from 296 leading medical insurers operating in 79 countries, including Asia Pacific. The survey tracks information about medical costs, what is driving them and how they are being managed, as provided by leading global insurers.