Vn-Index predicted to hit all-time high of 1,300 pts in April

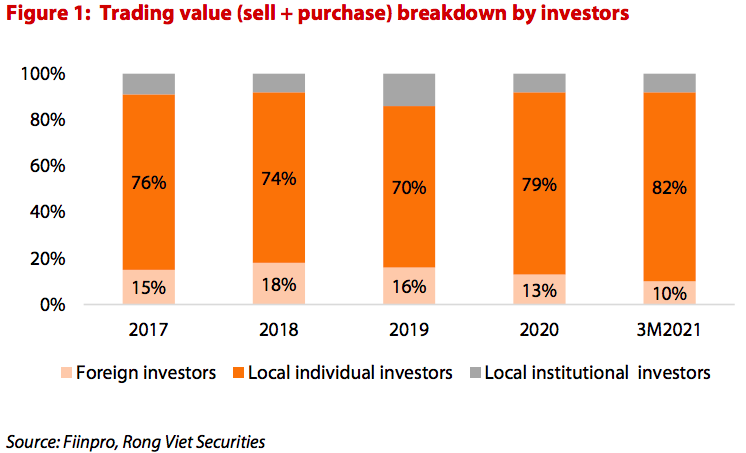

Strong involvement of individual investors and participation of new foreign fund would help offset the net selling trend of foreign investors.

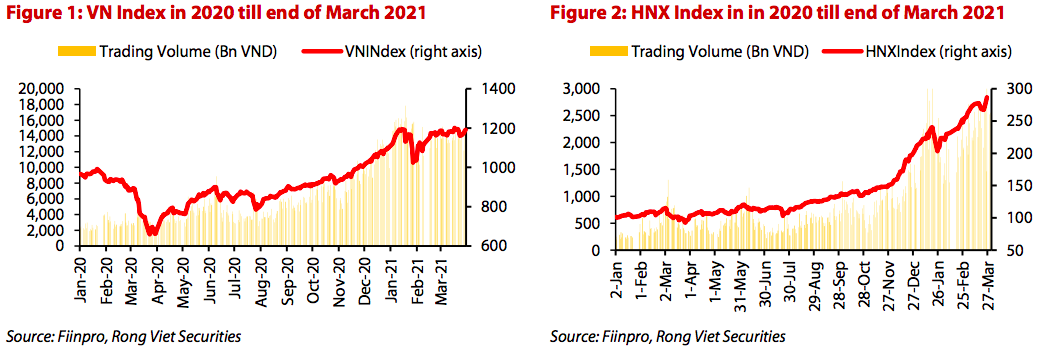

Vietnam’s benchmark Vn-Index could reach its all-time high of 1,300 points in April, with new foreign cash flows and domestic individuals as key market drivers.

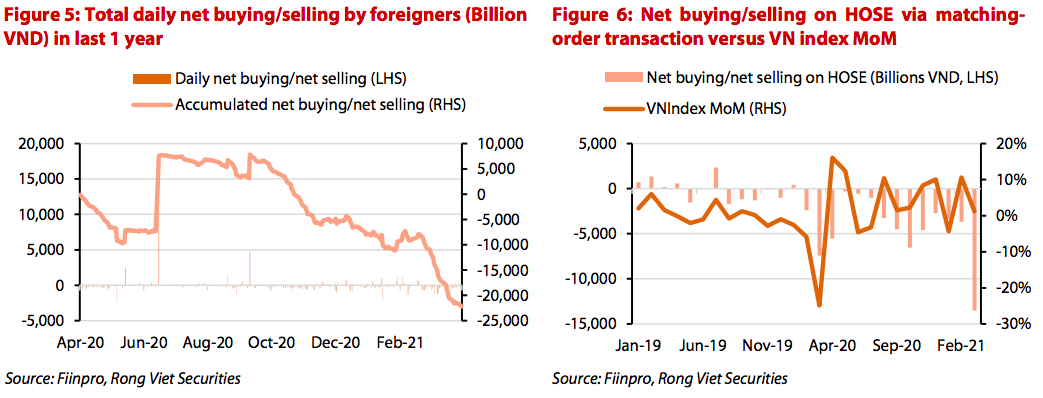

The new capital inflow would help offset the net selling trend of foreign investors, said the Viet Dragon Securities Company (VDSC) in its monthly report.

According to the VDSC, the stock market in April will maintain their upward movement from March, with the Vn-Index ending the month with a gain of 1.23% month-on-month to 1,191.44.

“Capital inflow pumped by foreign funds and domestic investors, along with positive business performance outlook in banking stocks are two main catalysts. However, inherent risk would be the unsolved issue of overloaded trading system in short-term,” stated the report.

In the past year, foreign investors maintained net selling position with large value of VND29.3 trillion (US$1.27 billion).

“However, we did not recognize it as considerable risk thanks to the strong involvement of individual investors and participation of new foreign fund,” stated the VDSC.

On March, the new ETFs from Taiwan - Fubon FTSE Vietnam ETF by Fubon Financial Holdings was established. A few days later, Fubon FTSE Vietnam ETF conducted an IPO and raised TWD5.28 billion (US$185.3 million), while planning to mobilize further TWD10 billion (US$350.8 million) to invest in Vietnam stocks.

As this fund uses the base of FTSE Vietnam 30 Index, it is expected to supplement new inflows to VN30 group and possibly uplift the market, said the VDSC.

Banks to serve as main driving force supporting the market in April

VDSC’s report predicted the growth of bank’s profit-before-tax (PBT) to be 26% in 2021. The performance of the banking sector in the first quarter was even more optimistic with the three-digit growth of 115% in PBT thanks to the contribution of non-interest income, and negative growth in provision costs.

“Therefore, VN-Index would be likely to go further with the force from banking stocks,“ it added.

In April, one significant event will be the review of ETFs benchmarked VN30, VN Finlead and VN Diamond. In this restructuring period, banking stocks including ACB, EIB, MSB and VIB are expected to benefit from VN Diamond ETF Fund's cash flow when they meet the conditions to be added to the index basket.

| Local investors at a securities center in Hanoi. Photo: Viet Linh |

Picky approach is prioritized when VN-Index surpassed 1,200 points

After the end of annual general meeting (AGM) season, market would fall into “information scarcity” time. Therefore, the driving force of the market in the end of April and May may not be the same and the market could be subject to correction, especially when the issue of trading system has not been fully solved.

The report urged investors to adopt a bottom-up approach and focus on stocks having “better than expected result” in 2021.

At the close today [April 6], the Vn-Index rose by 0.32% or 3.91 points to 1,239.96, with foreign investors being net buyers of VND21 billion (US$910,000) on the market.