Vn-Index set to reach 1,850 in 2022: Experts

It’s about time for foreign investors to position themselves now and be ready for the moment when Vietnam is upgraded to Emerging Market status – a foreseeable prospect in the next few years.

The outlook of Vietnam’s stock market in 2022 and subsequent years is set to be positive, for which the benchmark Vn-Index may reach a new height of 1,850 points this year.

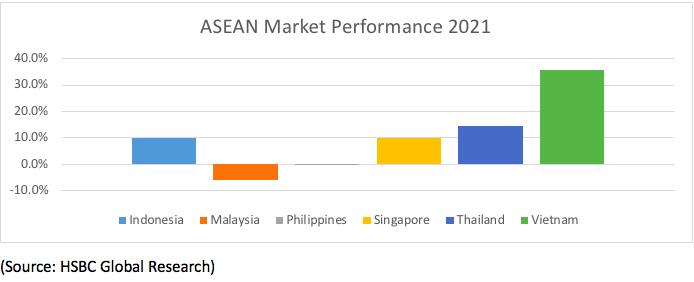

James Estaugh, head of Securities Services at HSBC Vietnam, assessed while stating Vietnam’s stock market was the best performer in ASEAN in 2021 ending the year at 1,498 points, up 35% year-on-year.

Estaugh explained his positive outlook for the market to improve market capability with the new KRX systems in place in 2022.

“The new technology will be capable of facilitating significant increases in trading volume and resolve system congestion… [at the same time] it will also provide the infrastructure to launch new products such as intraday trading, sale of receivable shares, and non-voting depository receipts (NVDRs), etc. which will attract new and increased foreign investment,” said Estaugh.

Another important and long-awaited development will be the removal of the mandatory cash prefunding requirement for buy trades via the launch of the new settlement and clearing system under the Central Counterparty Party (CCP) model. The CCP model is planned to be launched alongside the new KRX systems and means investors will no longer have to prefund their purchases.

“This should increase the purchasing powers of investors in general and foreign investors in particular, supporting Vietnam to attract more foreign investments,” he added.

Estaugh also mentioned the expectation for the return of the foreign capital inflows. Vietnam’s stock market experienced a record high net selling by foreign investors in 2021 valued at VND62.3 trillion (US$2.74 billion).

However, he suggested such a trend would be reversed in 2022. Apart from the favorable macro factors, Vietnam’s market has the attractiveness to lure foreign investors. They have undertaken net buying since the first few weeks of 2022.

| Stock market is fast becoming an attractive investment channel for local investors. Photo: Thanh Hai |

Returning of foreign capital inflows

Even though Vietnam’s foreign ownership limits (FOL) have not been changed much, a quick look at the VN30 Index, which comprises 30 large caps, confirms foreign investors have enough investable stocks to choose from. Of the 30 stocks in the VN30, only five have reached foreign ownership limits, 13 stocks have market caps above US$5 billion, and 12 trade at more than $10 million a day.

Meanwhile, Exchange Traded Funds (ETFs) continue to help foreign investors gain exposure to companies that have reached foreign ownership limits. In 2021, local ETFs delivered average growth of 40% vs 24.7% for foreign ETFs. Non-Voting Depositary Receipts (NVDRs) and Covered Warrants with underlying assets being indices offer investors further opportunities to earn profits from securities that are already at their foreign ownership limits.

“It’s about time for foreign investors to position themselves now and be ready for the time when Vietnam is upgraded to Emerging Market status – a foreseeable prospect in the next few years,” he added.

Backing up HSBC’s view, data from the SSI Securities Corporation showed ETFs have been posting a net-bought amount since early 2022, with names such as Fubon ETF (raising VND1.14 trillion), Premia Vietnam ETF (VND12 billion), and SSIAM VNFIN Lead (VND152 billion), accumulating a net gain of VND938 billion in January.

Experts from the SSI noted all signs are pointing to a return from foreign capital to the local market, given the recovery of the global economy and stable foreign exchange policy in Vietnam.

“The VND continues to show strong resilient despite others in the region facing depreciation risks from a more expensive US dollar in case Fed rising policy rates,” they said.

In addition, Vietnam’s market is set to welcome another investment fund from Taiwan, namely the Jih Sun Vietnam Opportunity Fund (JSV Fund), which carried out an IPO on January 10, 2022, with nearly VND5 trillion mobilized.

The VN-Index hit an all-time high of 1,500.81 points on November 25, 2021. According to Vietnam Securities Depository (VSD), the overall total number of securities account openings in Vietnam reached about 4.3 million by the end of 2021, an increase of 50% compared to the end of 2020, 39,000 of which were opened by foreign investors, 11% up over the same period last year.

According to HSBC Global Research, Vietnam provides even better relative value vs competing Emerging and Frontier markets as: (1) Vietnam’s current premium to the Asia (ex-Japan) GEM and FM indexes is less than the historic average; (2) Vietnam’s valuation premium should be higher given the market is generating higher ROEs than in the past.

As a result, the capitalization of the stock market hit a record high of VND7,729 trillion by the end of 2021, a 46% year-on-year growth, accounting for 122.8% of the country’s GDP.

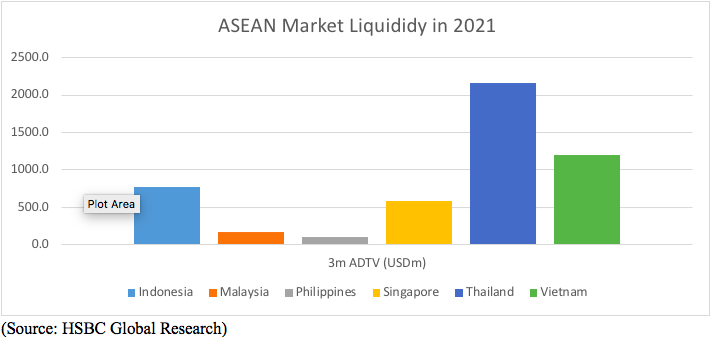

In November 2021, trading value hit a record high of VND56.3 trillion ($2.2 billion). In 2020 average turnover was $430 million, growing to VND25,960 billion per session ($1.13 billion) in 2021. To put this in context, Thailand’s average $2 billion per day, Indonesia $800 million, Singapore $500 million, and the Philippines $100 million.