VND more resilient compared to regional peers amid Covid-19: VinaCapital

With nearly US$83 billion of foreign exchange reserves, the State Bank of Vietnam has more than enough reserves to comfortably meet redemptions.

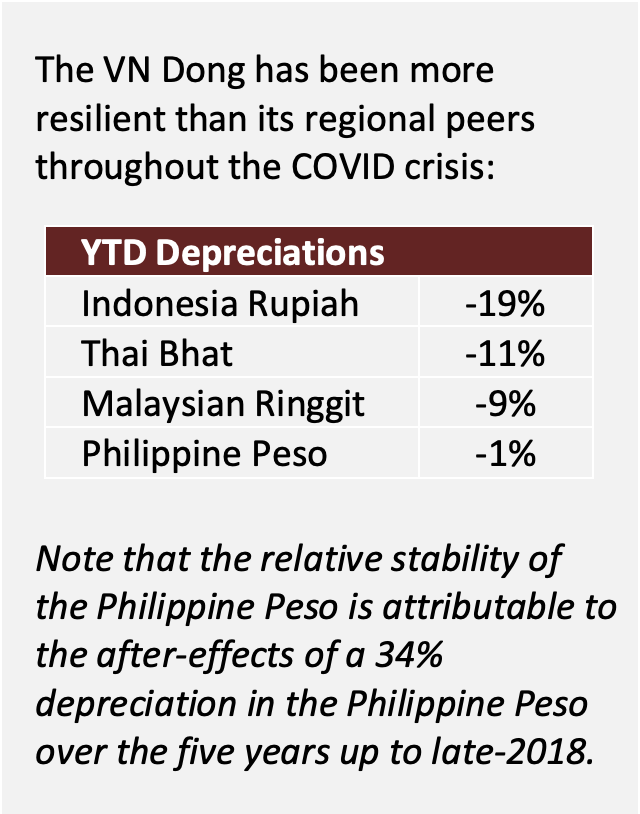

The Vietnamese dong (VND)’s depreciation of about 3% year-to-date is still smaller than the ones seen by most of Vietnam’s regional peers throughout the Covid-19 pandemic, according to VinaCapital, Vietnam’s major asset management firm.

| Source: VinaCapital. |

The unofficial value of the VND depreciated by about 1.7% last week, and by about another 1% on March 23 to circa VND23,900 to USD1.

In its latest report, VinaCapital expected the USD/VND exchange rate to stabilize at around the current level, due to (i) The Federal Reserve (Fed) took concrete actions to stop the surge in the US dollar index (DXY) last week; (ii) The State Bank of Vietnam (SBV), the country’s central bank, does not need to impose capital controls – so it is not contemplating any restrictions; (iii) The VND is supported by high bank deposit interest rates and 33%/GDP of foreign exchange reserves.

Foreign investors aggressively sold Vietnamese stocks last week, prompting concerns among some locals that the SBV may restrict the flow of US dollars out of the country, which was one of the factors that prompted last week’s VND depreciation.

However, VinaCapital deemed the SBV has more than enough reserves to comfortably meet redemptions.

“Vietnam’s US$83 billion of foreign exchange reserves are much larger than the country’s cumulative of nearly US$30 billion of foreign indirect investment (FII) in-flows, and a high proportion of those FII are inflows into illiquid private equity and/or large strategic stakes in publicly listed companies – both of which cannot be sold quickly,” it said.

Foreign investors sold around US$260 million worth of stocks last week, but unlike past global “risk off” episodes when investors sold Vietnamese stocks but kept the funds in the country (e.g., at the end of 2018), this time some investors are repatriating USD back to their home countries in response to the current global shortage of USD.

Factors that add up to VND’s current strengths are Vietnam’s trade surplus that has reached nearly US$3 billion year-to-date as of mid-March, including a surplus of nearly US$900 million in the first two weeks of this month, driven by 7% year-on-year export growth.

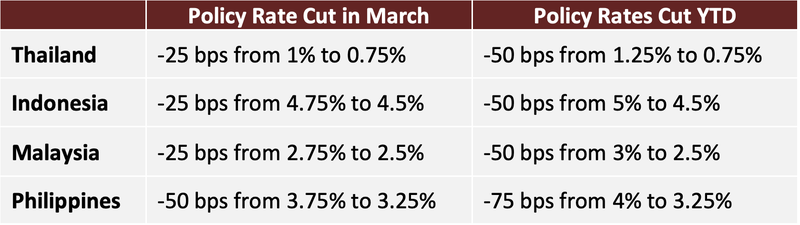

| Source: VinaCapital. |

Vietnam’s deposits rates are attractive compared to regional peers, and are becoming even more attractive as regional peers’ central banks of Thailand, Indonesia, Malaysia and the Philippines slash policy interest rates.

Last week, Vietnam’s government also lowered the maximum permissible deposit rate for bank deposits of below 6-month maturity to 4.75%, but savers who are able to lock up their money for 6 months can now earn interest rates of 7-8% from reputable banks, including from some foreign banks operating in Vietnam.

Furthermore, since Vietnam has not been a major recipient of the “hot money” inflows that destabilized ASEAN tiger economies in the past (for example, the proportion of Vietnam government bonds owned by foreign investors is very low, unlike in Indonesia), the SBV is well positioned to meet any potential short-term panic redemptions by foreign investors, concluded the report.