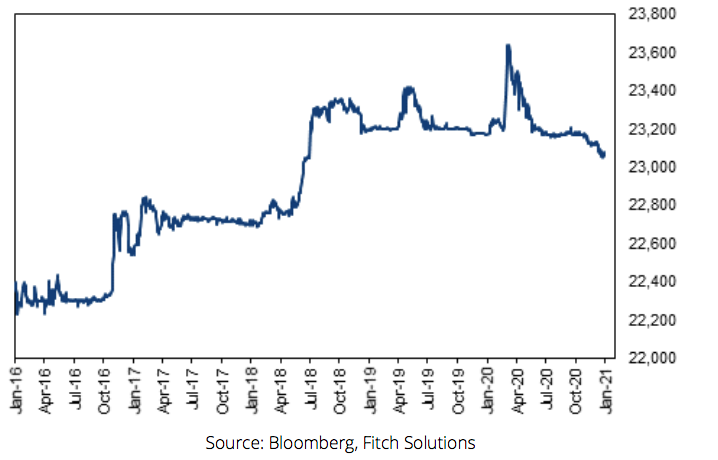

VND set to continue trading stable in 2021

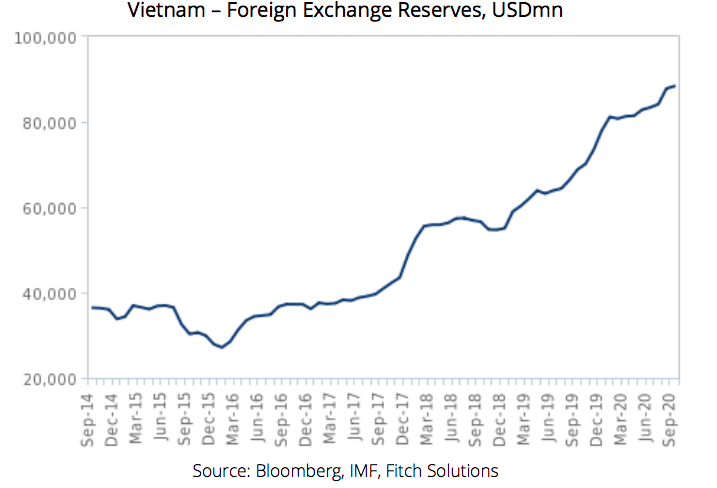

Strong currency inflows from trade surpluses and FDI will support the VND, while an adequate foreign reserve position will also allow the central bank to ease off its foreign currency purchases over the near term.

Fitch Solutions, a subsidiary of Fitch Group, forecast the Vietnamese dong (VND) to average VND23,100/USD, from VND23,400/USD previously, reflecting a stable outlook over the course of the year.

| Vietnam – Exchange Rate, VND/USD. |

“Strong currency inflows from trade surpluses and foreign direct investment will support the dong while an adequate foreign reserve position will also allow the central bank to ease off its foreign currency purchases over the near term as it continues to ensure currency stability,” stated Fitch Solutions in a note.

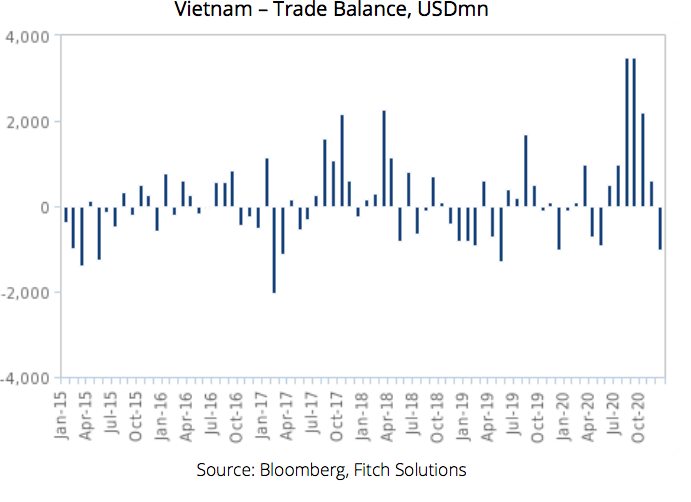

The dong previously remained flat against the US dollar and averaged VND23,215/USD in 2020. In 2021, Vietnam’s trade activity is expected to remain strong, supported by a turnaround in the global trade cycle and a global demand recovery.

Given that Vietnam’s exports typically have a high degree of import content, this means that both values tend to move fairly closely in general, although a higher volume of trade will still increase net inflows, added Fitch Solutions.

Vietnam’s export turnover in 2020 was estimated at US$281.5 billion, up 6.5% year-on-year, while imports came in at US$262.4 billion, up 3.6%.

Amid a challenging and uncertain economic environment in 2020, Vietnam’s registered FDI capital came in at $14.6 billion, down 12.5% versus 2019.

According to Fitch Solutions, the country’s effective measures against the Covid-19 pandemic would provide a boost to investor sentiment and confidence in operating in the country and support FDI inflows.

The State Bank of Vietnam (SBV) estimated reserves to reach about US$100 billion by end-2020, as such, this will reduce the pressure on the SBV to continue its aggressive building of its foreign reserves position, asserted Fitch Solutions.

The SBV has also announced a new policy on foreign exchange purchases from commercial banks which took effect from December 31, 2020.

Under the policy, the country’s central bank has stopped announcing the buying price of foreign currency and also its USD purchases in the spot market. From January 4, the length of USD forward contracts dealt by the SBV would be extended to six months, from three months previously.

A shift to forwards as opposed to spot market intervention will allow the SBV to manage banking system liquidity without immediately having a direct effect on its foreign reserves position, it added.

With Vietnam currently being labeled a currency manipulator by the US Treasury Department, Fitch Solutions believed that this might be a strategy adopted by the SBV to avoid violating one of three criteria associated with the label, which is ‘persistent, one-sided intervention occurs when net purchases of foreign currency are conducted repeatedly, in at least six out of 12 months’, and in the process stave off the threat of punitive tariffs by the US.

“This policy shift could also imply a slightly more flexible exchange rate over the short term,” Fitch Solutions suggested, but adding the SBV would still intervene to limit dong strength, as a sharp strengthening of the dong would erode Vietnam’s export competitiveness especially at a time when the country is aggressively increasing its integration into global supply chains and its reliance on external trade for growth.

Indeed, Vietnam’s trade prospects continue to look bright with its participation in the EU-Vietnam Free Trade Agreement (FTA), the UK-Vietnam FTA, and the Regional Comprehensive Economic Partnership, as well as the ongoing relocation of export manufacturing operations to the country from China due to the US-China trade war.

Long-Term Outlook

Fitch Solutions expected the VND to remain on a gradual weakening trend against the US dollar over the long term. Factoring a stronger 2021 forecast, it predicted the VND to average VND23,200/USD in 2022, from VND23,600/USD previously.

“This is due to the dong’s persistent overvaluation and higher structural inflation in Vietnam versus the US,” it added.

The Vietnamese dong’s real effective exchange rate (REER) is 4.5% above its 10-year average, which continues to suggests slight currency overvaluation and could lead to some weakening pressures over the coming quarters.

The agency forecast inflation in Vietnam to average 3.5% in 2021 and 2022, relatively similar to 3.2% in 2020.

Vietnam’s strong economic growth prospects, in which the real GDP growth is predicted at 8.6% in 2021 and 6.7% in 2022. Such figures far exceed the estimated growth of 4.1% and 1.8% for the US, respectively.

“This suggests that continued strong investment flows to Vietnam will limit scope for VND weakness,” stated Fitch Solutions.