IMF expects Vietnam’s strong economic performance amid Asia’s dim outlook

Vietnam’s upbeat growth outlook is bucking the slowing trend elsewhere in Asia.

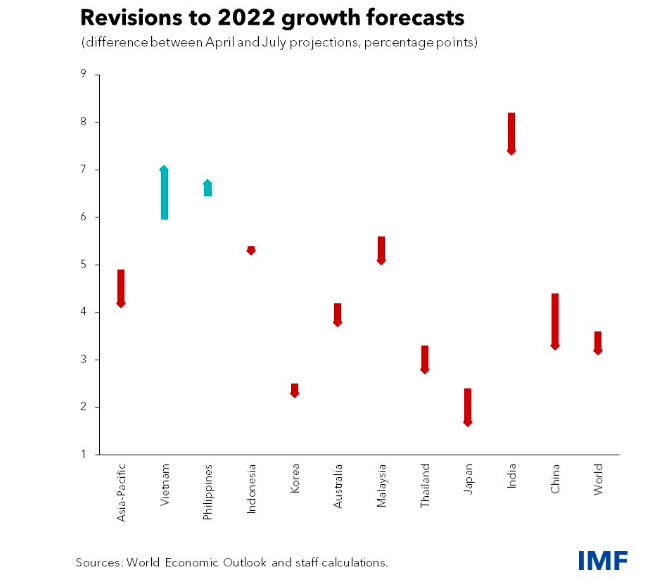

The International Monetary Fund (IMF) has revised Vietnam’s GDP growth forecast for this year from 6% to 7% and remains the only significant upward revision among major Asian economies.

“Vietnam’s upbeat growth outlook is bucking the slowing trend elsewhere in Asia, with relatively subdued inflation that’s also an exception to the general rule in the region,” noted the IMF.

For next year, the IMF lowered its projection for Vietnam by 0.5 percentage points to 6.7%, but noted that "contrasts with dimming prospects elsewhere and would be the fastest pace among Asia’s major economies.”

As such, growth estimates for Asia were lowered to 4.2% and 4.6% for this year and the next in the IMF’s latest World Economic Outlook Update.

According to the IMF, the first half of this year saw a swift economic rebound as Vietnam’s pandemic restrictions eased following the adoption of a living-with-Covid strategy and a robust vaccination drive.

Meanwhile, supportive policies such as low-interest rates, strong credit growth, and the government’s Program for Socioeconomic Recovery and Development have been accompanied by strong manufacturing output and a recovery in retail and tourism activity, it added.

The IMF also pointed out the limited inflation pressure in Vietnam on goods like fuels and related services like transport. “Consumers are largely insulated from the global surge in food prices because of ample domestic supplies, pork prices declining from last year’s peak, and a preference for rice, which remains cheaper than other grains like wheat,” stated the agency, noting price gains for services, such as health and education, have also been very mild.

Consumer prices in the first seven months of the year rose but remain below the central bank’s 4% target for the year. The economy’s delayed recovery last year has kept core inflation, which strips out volatile food and energy costs, below regional peers.

The IMF, however, warned that inflation could pick up as economic activity gets back to full speed. Higher costs of transportation and commodities such as fertilizers and animal feed could also raise prices of a broader range of goods and services, adding inflationary pressure.

Vietnam’s recovery also faces headwinds from global growth decelerating from 6.1% last year. The IMF’s World Economic Outlook lowered the estimate to 3.2% this year and 2.9% next year amid the effects of the Russia-Ukraine conflict, and the slowdown in China and major advanced economies.

| Manufacturing of electronic production at Hoa Lac Hi-tech Park. Photo: Thanh Hai |

“Such a slowdown implies reduced demand for Vietnam’s exports, especially from key trade partners like the US, China, and the EU,” stated the IMF.

In addition, tightening financial conditions due to interest rates rise in the US and other advanced economies to curb inflation could also hurt Vietnam’s economy, the IMF continued as it referred to increases in financial costs and subsequently capital outflows from emerging markets in the region.

Timely changes to ensure sustainable growth

The IMF called for Vietnam to put fiscal policy at the central role in aiding recovery, yet flexible adjusted to evolving economic conditions.

The SBV should focus on rising inflationary risks, and communicate that it is ready to act as needed and remains committed to meeting its inflation target.

Bad loans in the banking sector are also a cause of concern and the authorities should closely monitor for potential risks in real estate markets to safeguard financial stability.

Labor markets would benefit from reducing the mismatches that result if workers don’t have the right job skills, and more formal employment should be encouraged by improving skills and lowering costs for companies to formalize.

The IMF noted social safety net coverage should be scaled up and made more efficient. Climate-related risks can be addressed through concrete policy actions to invest in climate adaptation, reduce carbon emissions, and achieve the country’s ambitious environmental agenda.

“Tackling these challenges will further unleash Vietnam to its considerable growth potential and continue advancing on a sustainable development path toward higher income status. Importantly, the country’s development strategy already includes reforms like these, and decisive implementation will help foster sustained, inclusive, and green growth,” stated the IMF.

Hanoi’s gross regional domestic product (GRDP) is estimated to expand by 9.69% in the first nine months of this year, the highest growth rate in recent years, according to the municipal Department of Statistics. “Such positive growth remains an encouraging result amid complicated global situation, including the Russia-Ukraine conflict, rising prices of essential commodities, and the energy crisis in Europe,” noted the Hanoi Department of Statistics. Amid a dim international economic outlook, the Government has timely conducted supporting measures to stabilize energy and food prices, along with a flexible and safe approach to keep the Covid-19 pandemic under control, it added. |