What's behind Masan-Vingroup merger?

Vingroup is now able to focus on its core businesses while Masan found its last piece of a puzzle to build an empire of consumer retail.

The merger of Vingroup’s retail arm VinCommerce and its farming subsidiary VinEco into Masan Consumer Holdings, the consumer business of Masan, is expected to become a turning point for these two giants.

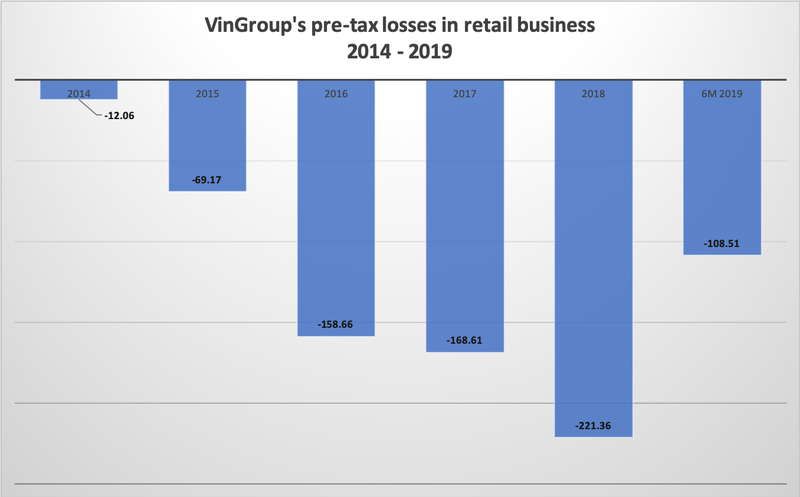

| Unit: Million USD. Data: Vingroup's financial statements. Chart: Ngoc Thuy. |

For Vingroup, Vietnam’s largest privately-run conglomerate, the agreement allows it to focus on its emerging businesses namely manufacturing and technology, while Masan obtains its last piece of a puzzle to build an empire of consumer retail, eventually penetrating international markets.

Under the agreement, a new consumer retail group would be established, with Masan taking control of and Vingroup swapping its stake in VinCommerce for that of the new company and becoming a stakeholder.

A report from MB Securities Company (MBS), retail sales of Vietnam’s market reached a new record high of US$142 billion in 2018, with a compound annual growth rate (CAGR) of 13%, 1.5 times higher than the country’s economic growth rate.

As the country’s middle class is expanding at the fastest growth in the Asia – Pacific region, not to mention 50% of the population at the working age and over 40% below 24 years of age, Vietnam’s retail market is projected to maintain its strong growth in the coming years.

Despite its huge potential, the competition becomes fiercer than ever. Vingroup’s financial statements over the last few years revealed its retail business has been facing huge losses. The timing coincided with VinCommerce expanding its Vinmart and Vinmart+ networks.

In 2014, Vingroup’s retail business recorded revenue of VND454 billion (US$19.63 million) and a loss before tax of VND279 billion (US$12.06 million). Four years later, its revenue surged to VND21.25 trillion (US$918.93 million), only behind the group's real estate business, but it incurred a loss of VND5.1 trillion (US$220.53 million).

Nevertheless, Vingroup now dominates Vietnam’s retail market with a network of over 100 Vinmart super markets and over 2,400 VinMart+ stores across 50 cities/provinces.

With a rapidly-expanding retail market, Vingroup is expected to "burn" more money to maintain its leading position.

Tran Viet Bang, director at Dong A Solutions, said the merger would help Vingroup save billions of dollars, at the same time having a 30 – 35% stake at Vietnam’s new top retail group.

More importantly, retail business remains part of Vingroup’s ecosystem with less expenses, Bang added.

From Masan’s point of view, the acquisition of network of VinMart super markets and Vinmart+ convenience stores is necessary for the group to control the distribution channel for its fast moving consumer goods (FMCG). Its meat business, Masan MEATLife, and VinEco with 14 high-tech farms would be useful to support each other in the process of producing fertilizers, animal feed and meat.

Bang added the acquisition would help Masan maximize its profit by reducing intermediary cost through directly selling products to consumers.

An analysist told Zing he would not rule out a possibility that South Korea’s conglomerate SK Group may be a big factor behind the deal between Vingroup and Masan.

In 2018, SK become Masan’s strategic investor with an investment of US$470 million. In May, the South Korean group invested US$1 billion for a 6% stake in Vingroup.