Vietnam among top 5 markets for new offshore wind installations in 2030

The country has drawn significant interest among international developers, investors, and financiers as a fast-growing market.

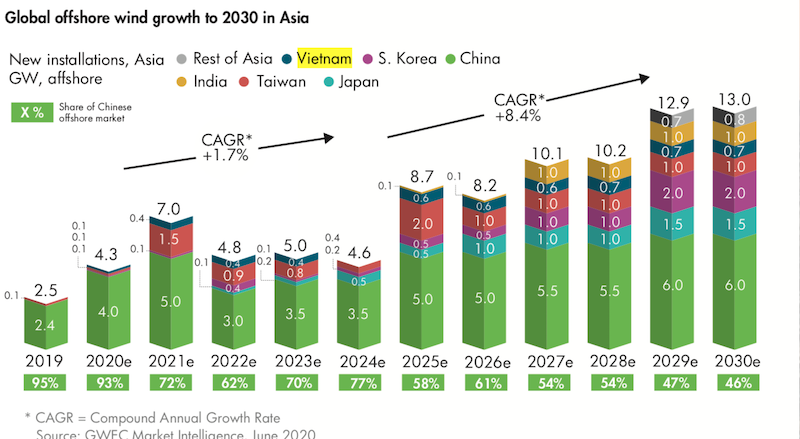

With a total of 5.2GW offshore wind capacity built in 2020-2030, Vietnam is placed among the top five markets in Asia in new installations in this decade, behind China (52 GW), Taiwan, China (10.5 GW), South Korea (7.9 GW), and Japan (7.4 GW), according to the GWEC Market Intelligence’s latest market outlook.

| Source: GWEC Market Intelligence, June 2020. Screenshort: NM |

The Global Wind Energy Council (GWEC) Market Intelligence’s latest market outlook predicts that China will continue to dominate the Asian offshore wind market in the first half of this decade, with more than 70% market share. Taiwan is expected to be the largest offshore market in Asia after China in new installations in the same period.

“Over the coming decade we will see emerging offshore markets like Japan, Korea and Vietnam move to full deployment, and see the first offshore turbines installed in a number of new countries in Asia, Latin America and Africa,” Ben Backwell, CEO at GWEC said.

Asia is set to become a leader in offshore wind, with its share in the global offshore wind market expected to grow from 24% in 2019 to 42% in 2025 and the rest of the decade. In Asia, the average annual growth rate will stay at the level of 1.7% in the first half of this decade, but is likely to increase to 8.4% in the second half.

However, the scales will tip from 2025, when more utility-scale offshore wind projects get connected in Japan, South Korea and Vietnam. GWEC Market Intelligence forecasts that China’s market share in this region is likely to drop to 58% in 2025 and will continue to decline when offshore projects expand to new markets with high resource potential, like India and the Philippines, towards the end of the decade.

Excluding China, the Asian offshore wind market is still at the early stage of development. Each market is facing the challenge of developing a local supply chain and the necessary competencies and capabilities to build an offshore wind industry.

Vietnam’s offshore market

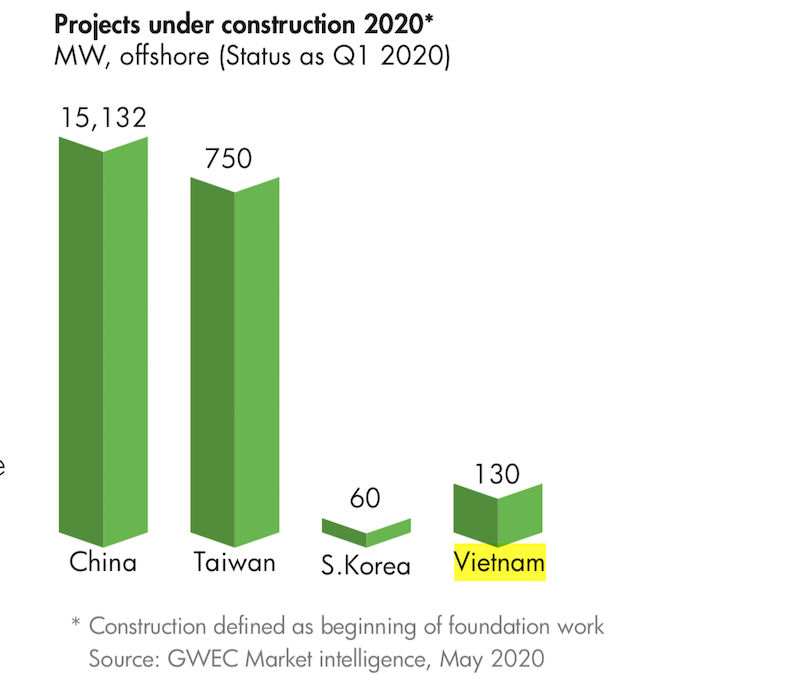

More than 500 MW offshore wind projects in the pipeline in Vietnam are expected to come online before the current feed-in tariff (FiT) deadline of November 2021.

| Source: GWEC Market Intelligence, May 2020. Screenshot: NM |

Offshore wind is prioritized in the government’s plan to build a “blue economy” – developing marine- based renewables to meet energy needs – and achieve energy security. Since revising Vietnam’s Power Development Plan VII (PDP) in 2016, the government has been reorienting its reliance on coal to prioritize clean energy sources. The Party Central Committee's Resolution No. 55-NQ/TW, published in February, outlines measures to liberalize the energy sector and reduce the share of coal-fired generation in the power mix.

In July, the government formally approved a list of 91 additional wind projects totaling 7 GW, on top of the 4.8 GW of planned wind capacity (78 projects) already approved under the current master plan.

Projects in operation (377 MW) and those with power purchase contracts with EVN (1,662 MW) are excluded from the figures above. All of these puts Vietnam on track for a total wind power generation capacity of nearly 14 GW latest by 2030, the report wrote.