Vietnam benchmark Vn-Index expected to surpass June’s peak to 920 in Sept

The recent uptick of the market, however, is not sustainable, when the margin outstanding may have increased sharply along with the rise.

The upward momentum of August and the expectation of new foreign capital could support the benchmark VN-Index to surpass its June peak at 900 points, and possibly reach 920, according to a report from Viet Dragon Securities Company (VDSC).

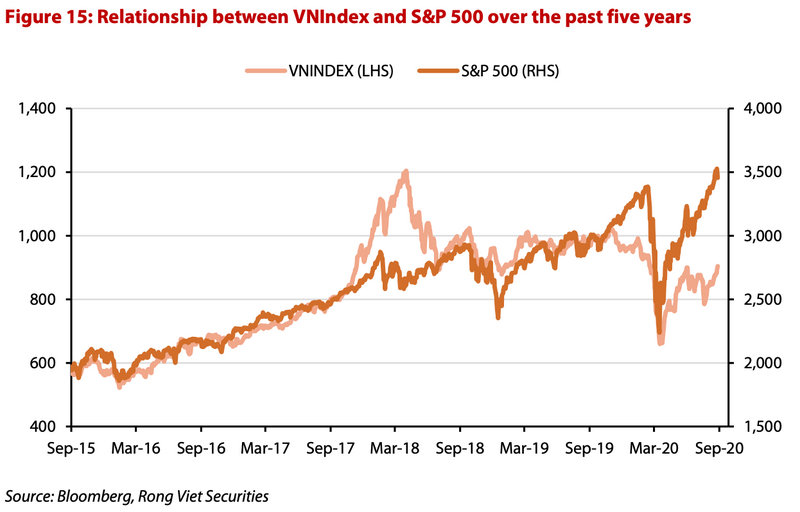

However, VDSC suggested that the recent uptick of the market is not sustainable when, based on its observations, the margin outstanding may have increased sharply along with the recent rise. In that context, market sentiment will be easily affected by negative news, including strong volatility of global stock markets, it added.

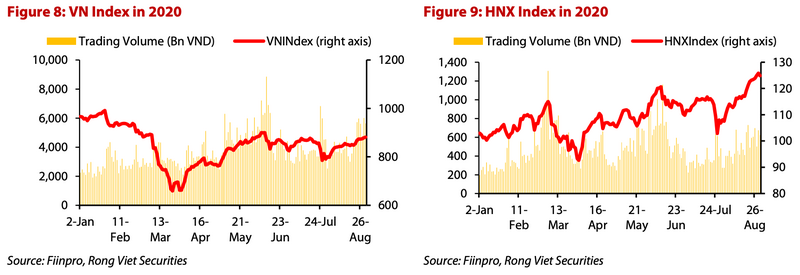

Vietnam's stock market was one of the best performing markets in the world in August as the VN-Index increased by 10.4% month-on-month to 881.65.

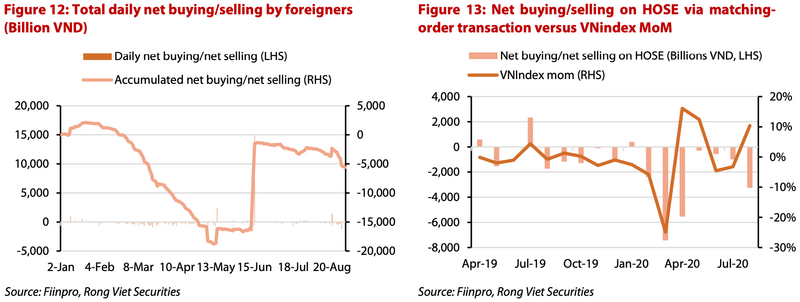

Besides the uptrend momentum of August, VDSC also expected more positive from the foreign investors. In the context that they have remained net sellers for months, the news about the fund raising of US$160 million by a Taiwanese fund and the fact that Dragon Capital also mobilized a large amount of money from abroad for VFMVSF fund of VietFund Management (VFM) are positives. Since the end of June, this fund has received about VND1.5 trillion (US$64.6 million) from foreigners.

According to data from VFM, VFMVSF fund has disbursed the equivalent of more than VND1.1 trillion (US$47.35 million) in August. The fund's portfolio is mostly large-cap stocks with high liquidity.

Uptrend boosted by “cheap” money

The stock market has become attractive because of low required-invested-capital and high liquidity. It appears to be a better investment than other channels like gold or real estate in the uncertain economic outlook and the continuing decrease of deposit rates, stated VDSC.

Hence, not only local investors but also foreigners continue to buy stocks, ignoring the unsatisfactory results of economic indicators. New opened brokerage accounts in August were up by 4.8% month-on-month to 28,300 accounts, the highest figure since 2019 (15,000 – 20,000 accounts per month).

In addition, margin lending outstanding balance surged since late July showing the ‘excitement’ of existing investors, as margin lending in late August was up by 40% compared to June.

Regarding foreigners, new cash has flowed into professional funds, which imply a positive signal for stock indices. Though part of such cash may go into in mid-cap stocks, blue-chips are still preferred due to strong fundamentals and transparency. That could push the VN Index higher in September.