Vietnam benchmark VN-Index set to go sideways in November

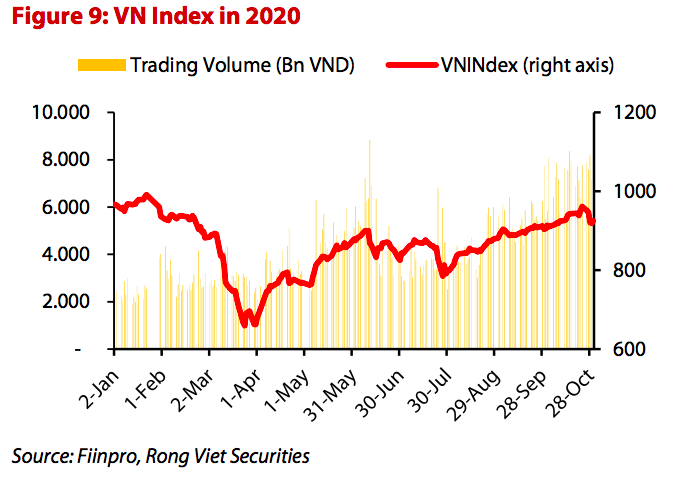

The VN-Index edged up 2% month-on-month in October to finish at 925.47 and was among the best-performers in the world.

As the third-quarter earnings season wrapped up, Vietnam’s stock benchmark VN-Index is set to go sideways in November due to a vacuum of information on corporate earnings and macro data, according to Viet Dragon Securities Company (VDSC).

As such, it is likely that the market will be more sensitive to global markets and international events, including the results of the US presidential election, stated the securities firm in its monthly report.

However, the continuous recovery of the market is predictable followed by good momentum in the third-quarter. The VN-Index edged up 2% month-on-month in October to finish at 925.47 and was among the best performers in the world by outperforming other indices such as SET (-3.4%), KOSPI (-2.6%), S&P 500 (-2.8%) for a third consecutive month.

In the coming months, macroeconomic data, supported by a recovery from the Covid-19 pandemic, along with low interest rates environment, will likely keep money flowing to the market, it added.

The current concern is the global market volatility in the short term due to uncertainty of the US presidential election. Therefore, VDSC expected the VN-Index to move in the range from 910 to 960 this month.

The average liquidity in the Hochiminh Stock Exchange, home to the majority of large-caps, via matching orders was VND7.2 trillion (US$310.64 million), up 31% month-on-month. The VN30-Index, which accounted for 56% of the VN-Index liquidity, was up 68% month-on-month in October.

According to VDSC, the MSCI update was a main reason for the VN30 to rally given the expectations from new inflows into the largest frontier market. Specifically, VN30 stocks would most benefit as Vietnam would see a weight increase of 13% in the frontier markets index as Kuwait will be reclassified as an emerging market.

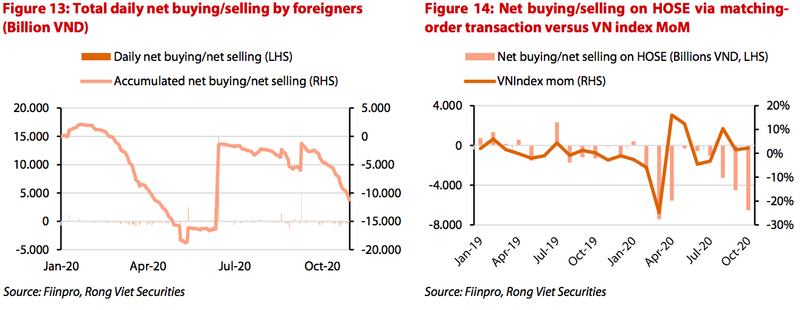

Meanwhile, despite the recent announcement from MSCI, foreign investors still sold intensively in October when net selling value reached a six-month high. Therefore, money flows from foreign investors would not be a supporting factor now.

Positive economic outlook to boost market sentiment

In addition, the developments of the last National Assembly session in 2020 will also be a major event to watch this month. From November 2 to 5, the National Assembly discussed and evaluated the results of the implementation of the five-year socio-economic development plan for 2016-2020 and, more importantly, the development of the plan for major economic indicators for the next five years (2021-2025).

The government has set a target of 6.0% GDP growth by 2021, compared with projected GDP growth of 2.0-3.0% in 2020, dragged down by Covid-19. However, the government sets ambitious targets for economic growth prospects over the next five years with an average GDP growth rate of 6.5- 7.0%.

VDSC expected that the approval of those long-term objectives as well as the government's commitment to execute the plan will have a positive impact on market sentiment this month.

Although the stock market is not expected to see a breakthrough in November, this is the right time for investors to start screening and accumulating stocks that are expected to have a more positive outlook in the fourth quarter as well as in 2021, VDSC recommended.

In the short term, opportunities still exist, but will be limited to a small group of stocks with supporting catalysts, such as firms in the fields of retail, real estate, and banking industries that could be profitable in the last months of 2020 and early 2021