Vietnam c.bank reportedly buys in US$2 billion past weeks

This resulted in more than VND46 trillion (US$2 billion) being pumped into the economy.

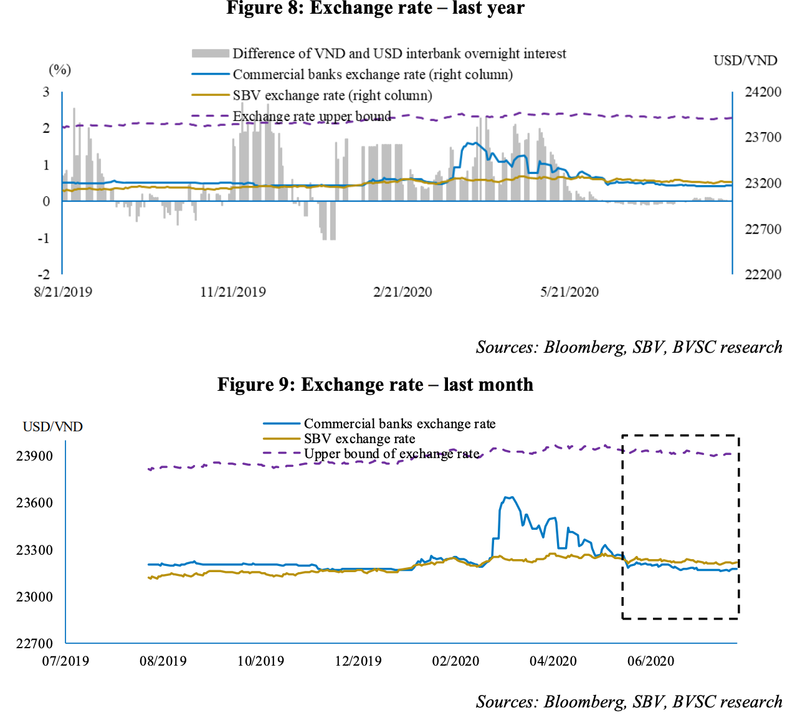

The State Bank of Vietnam (SBV), the country’s central bank, is reportedly to have bought in nearly US$2 billion in recent weeks to increase its foreign exchange reserves, according to Bao Viet Securities Company (BVSC).

This resulted in more than VND46 trillion (US$2 billion) being pumped into the economy.

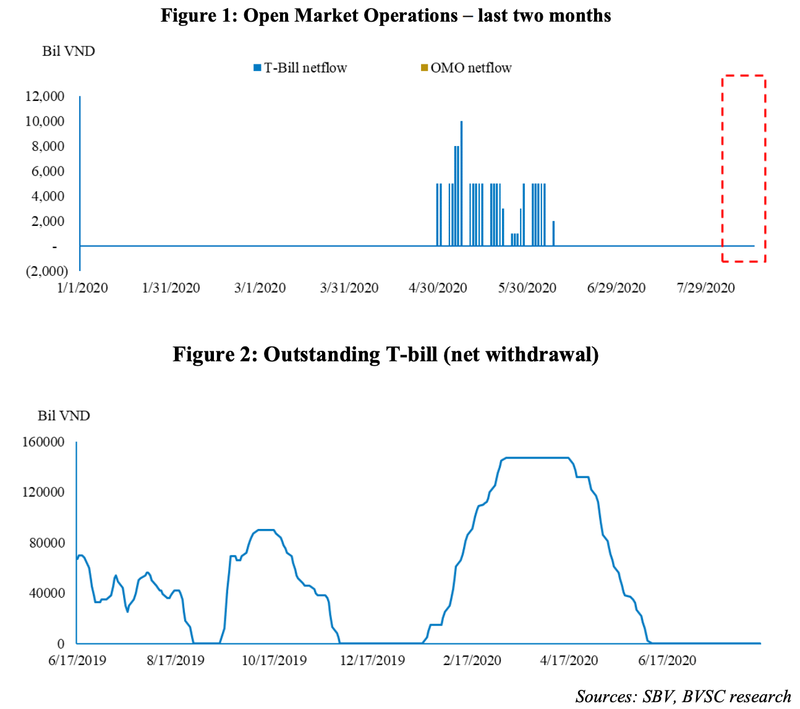

Meanwhile, the SBV did not plan to withdraw the dong through treasury bills, as a result, the system’s liquidity remains abundant, stated the securities firm.

“We believe that in order to stabilize liquidity and create more rooms for commercial banks to cut lending rates, the SBV may not intervene in the open market in the short term,” it added.

The information, if true, is understandable, due to the stability of the Vietnamese dong (VND) over the past few months and the ample supply of foreign currencies, mainly due to a decline in demand for foreign currencies from traders during the Covid-19 pandemic.

In the past weeks, the exchange rate at commercial banks has been hovering around the SBV’s buying rate at VND21,175, or even less in some sessions. The country posted a trade surplus of US$8.4 billion in the first seven months of this year.

BVSC forecast the VND may depreciate by no more than 1% against the USD in 2020.

Fitch Solutions, a subsidiary of Fitch Group, shared the same view with a prediction that the VND would average VND23,250 in 2020, from VND23,475 previously, or a decline of nearly 1%.

Fitch Solutions expected the VND to remain on a gradual depreciatory trend against the US dollar due to its persistent overvaluation and higher structural inflation in Vietnam versus the US, averaging VND23,400/USD in 2021.

At a government’s meeting on April 10, SBV’s Governor Le Minh Hung informed Vietnam’s forex reserves stood at a record high of US$84 billion.