Vietnam serves as strategic platform for diversifying global supply chain: AMRO

Vietnam’s economy is expected to maintain its growth momentum this year.

Vietnam continues to be a preferred destination for investors, given its attractiveness as a strategic hub for diversifying the global supply chain.

Chief Economist of the ASEAN+3 Macroeconomic Research Office (AMRO) Hoe Ee Khor told The Hanoi Times at the launch of its quarterly update of the ASEAN+3 Regional Economic Outlook (AREO) today [January 18].

| AMRO Chief Economist Hoe Ee Khor (l) at the launch. Photo: Nguyen Tung/The Hanoi Times |

According to Khor, the Vietnamese economy faced significant challenges last year and experienced a significant slowdown.

“However, it exhibited a robust rebound in the latter half of the year to reach a GDP growth of 5.1%, surpassing our initial expectations for GDP growth [4.7%],” he added.

Khor noted the economy would continue the growth momentum to hit an estimated economic expansion rate of 6%.

With the rate slightly below the official target of 6.5%, Khor pointed attributed the assessment to concerns over the export sector's recovery that displays a robust resurgence, due to sluggish external demand.

“Vietnam’s GDP growth rate remains high compared to other countries in the region,” he continued.

Meanwhile, the economist pointed out that Vietnam remains a preferred destination for investors, particularly in the context of the China+1 strategy.

Despite a slight dip to $23.2 billion in foreign direct investment (FDI) attraction compared to the previous year, the country continues to inspire optimism among investors.

Khor also pointed out that much of the investment comes from Chinese investors, given the rising costs in China.

“The attractiveness lies in Vietnam's potential to serve as a strategic platform for diversifying the global supply chain,” he noted. However, it is crucial to acknowledge Vietnam's vulnerability to external shocks, as evidenced by the recent downturn in the electronics cycle and manufacturing exports.

To enhance economic resilience, Vietnam should prioritize diversifying its export markets, moving away from dependence on a few countries. Additionally, there is a pressing need to ascend the value chain by shifting towards higher-value manufacturing exports.

These strategies will not only mitigate the risks associated with economic fluctuations but also position Vietnam for sustained and diversified growth in the long term, Khor suggested.

Positive outlook for the region

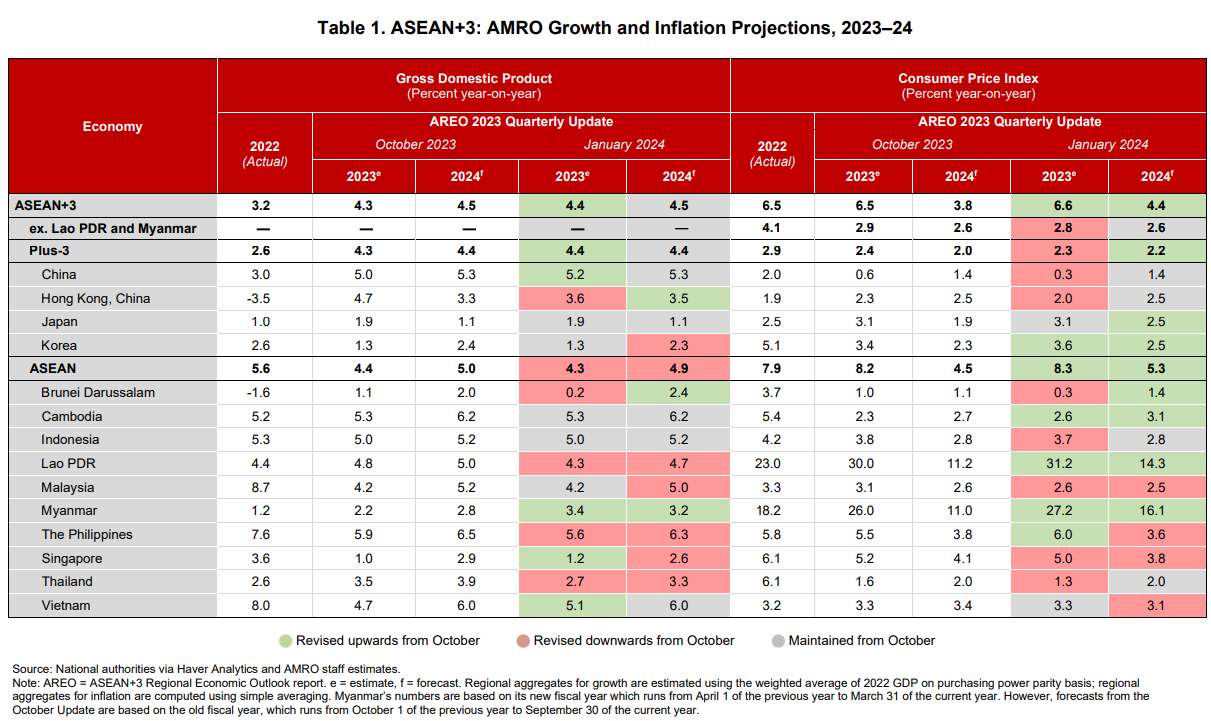

For the ASEAN+3 region (including China, Japan, and South Korea), AMRO expected an average growth forecast of 4.5%, thanks to strong domestic demand and moderating inflation.

The region is forecast to end 2023 with full-year growth of 4.4%, slightly higher than last October’s projection of 4.3%. The upward revision reflects China's higher growth of 5.2%, up from last quarter’s forecast of 5%.

Stabilizing industrial and service activities in the Chinese economy are helping to provide additional momentum for the region in 2024, alongside gradual improvement in exports to other key markets.

“The recovery in the global tech cycle is starting to be felt in the region’s export performance, especially in electronics,” said Khor. “But non-tech exports are lagging in terms of recovery, which is why recent manufacturing sentiment surveys are relatively mixed.”

Price pressures continue to recede across member economies, mirroring the trend in global commodity prices. Inflation in the ASEAN+3 region—excluding Laos and Myanmar—is forecast to moderate to 2.6% this year from an estimated 2.8% in 2023. Upside risks to inflation remain salient, however, and core inflation continues to be high in many economies.

“Spiking global commodity prices remains the main risk to growth, but there are several other wild cards. We still cannot rule out a US recession, for one,” Khor cautioned. “The lead-up to the US election in late 2024 could also exacerbate policy uncertainty and volatility in financial markets.”

AMRO estimates that a recession in the US and the eurozone this year could potentially halve the region’s GDP growth. The negative impact on the region’s growth would be amplified if the momentum in China’s economic recovery weakens in tandem.