Vietnam’s bond market grows 4.1% to US$53.6 billion in 2019

The government bond market decreased by 3.9% quarter-on-quarter in local currency terms to US$49.2 billion at the end of December 2019.

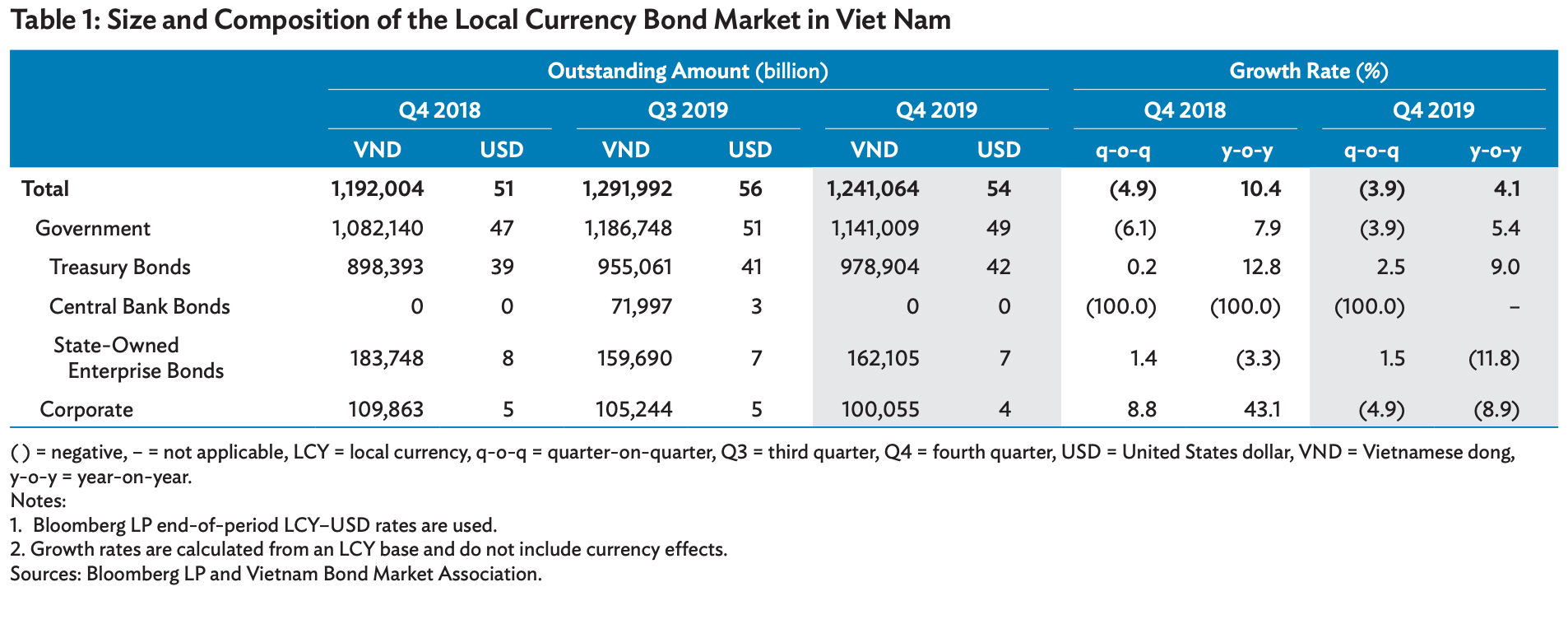

Vietnam’s bond market registered a decline of 3.9% on-quarter but up 4.1% on-year to US$53.6 billion as of the end of December 2019, according to the latest edition of the Asian Development Bank’s (ADB) Asia Bond Monitor.

This quarter-on-quarter decline was driven largely by the maturation of all outstanding central bank bills during the fourth quarter (Q4) of 2019.

New local currency (LCY) corporate debt issuance totaled VND1.7 trillion (US$71.68 million) in the fourth quarter of 2019, representing declines of 44.8% quarter-on-quarter and 86.3% year-on-year.

Vietnam’s 31 largest LCY corporate bond issuers had aggregate outstanding bonds of VND97.7 trillion (US$4.12 billion) at the end of December, accounting for a 97.7% share of the corporate bond stock.

Vinhomes, a real estate services arm of Vingroup, continued to hold the top post at the end of Q4/2019 with outstanding bonds of VND12.5 trillion (US$527.16 million).

Additionally, the government bond market decreased by 3.9% quarter-on-quarter in local currency terms to US$49.2 billion at the end of December 2019. The corporate bond market also contracted 4.9% quarter-on-quarter in local currency terms to US$4.3 billion at the end of 2019.

Covid-19 weights on bond markets

For other emerging East Asian economies, the Covid-19 pandemic and deepening global economic uncertainty are weighing heavily on local currency bond markets, added the report.

“Financial markets in the region are already feeling the brunt of the effects of the Covid-19 pandemic, with foreign investment and sector activities on the downside, coupled with ongoing trade issues,” said ADB Chief Economist Yasuyuki Sawada. “Efforts to cushion the negative impacts of the pandemic through stimulus packages and monetary measures to support affected households, businesses, and financial markets should continue.”

Apart from emerging East Asia, government bond yields also declined in major advanced economies and select European markets between December 31, 2019 and February 29, 2020 as investors took a risk-averse approach and local industries lessened activities due to the global health situation. This resulted in equity market losses in the region, weakened currencies against the US dollar, and widening credit default swap spreads. Market selloffs, which were observed in some regional bond markets in January and February, will likely continue.

Local currency bonds outstanding in emerging East Asia totaled US$16 trillion at the end of December 2019, up 2.4% from September 2019 and 12.5% higher than December 2018. Bond issuance in the region, meanwhile, totaled US$1.44 trillion in Q4 of 2019, a 9.5% decline from September last year.

At the end of December 2019, government bonds totaled US$9.8 trillion, 1.7% higher than September 2019. Corporate bonds, meanwhile, reached US$6.2 trillion on the back of 3.5% growth from September last year. China’s local currency bond market remained the largest in emerging East Asia, accounting for 75.4% of the region’s total.

Emerging East Asia comprises China, Hong Kong (China), Indonesia, South Korea, Malaysia, the Philippines, Singapore, Thailand and Vietnam.