Vietnam’s construction market struggles for sustainable growth

Most companies did not achieved the growth target for the January – September period.

Even though the fourth quarter is the peak season for construction activities, the fact that negative growth in revenues of major construction companies means that the construction market is still struggling to find a path to sustainable growth, according to Viet Dragon Securities Company (VDSC).

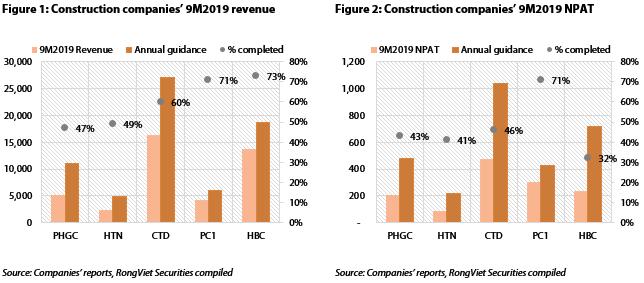

In terms of revenue, leading contractors in the residential segment completed a lower percentage of the year’s estimate, ranging from a half to three fifths of the target, except for Hoa Binh Construction (HBC), who achieved nearly 73% of its 2019 revenue target.

Power Construction No.1 (PC1), a contractor in the electricity construction business, stands out as it completed 71% of its target revenue for 2019. In terms of net profit after tax (NPAT), Ricons Construction Investment(PHGC), Hung Thinh Incons (HTN), and Coteccons Construction (CTD), are similar, completing less than half of their annual NPAT estimates, while that of HBC is roughly one third, different to PC1 which completed 71% of its annual target.

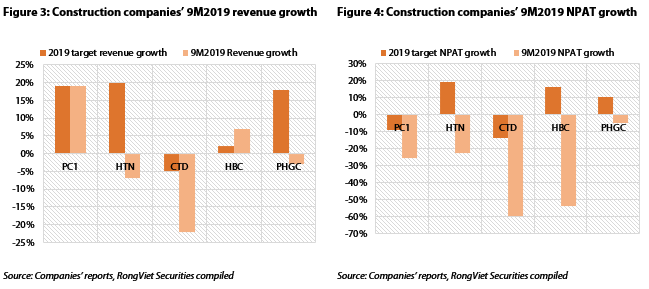

Compared to the same period last year it seems that most companies did not achieved the growth target for the January – September period, except for PC1 and HBC. As of the end of the first quarter in 2019, many contractors were optimistic on 2019 growth prospects. However, as nine months have passed, HBC was the only contractor which exceeded its annual growth rate target for revenue even though the exceeding amount is marginal (7% compared to the targeted 2%), while PC1 managed to match its expectations. HTN and PHGC, both of which are involved in large housing projects in urban areas, experienced negative year-on-year growth in the nine-month period, due to postponed progress at major projects. CTD seems to be the only one who had predicted the slowdown of the business but still saw a stronger reduction than expected (revenue down 22% in Jan-Sept versus a decline of 5% of whole year target).

All five large construction companies saw their net income decrease year-on-year in the January – September period. Except for PC1 whose performance was affected by discontinued real estate income, the remaining four companies, HTN, CTD, HBC and PHGC, seem to be in a contractionary phase. The larger the company is, the bigger the reduction in net income as CTD and HBC’ NPATs went down by 60% and 54% respectively. Smaller companies were less affected. Again, among residential building companies, only CTD had predicted that this would be the trend at the beginning of the year while HTN, HBC and PHGC seem to be surprised by the sudden slowdown.

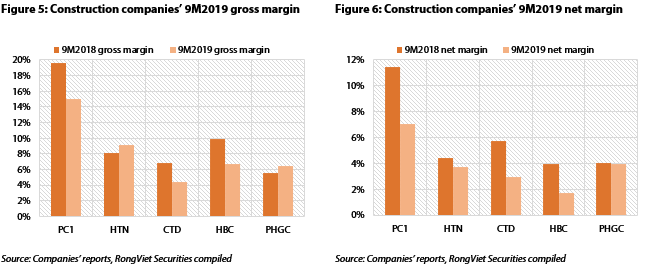

Gross margin results in the sector was uneven. Only HTN and PHGC managed to improve their gross margins. PC1, CTD and HBC’s were lower compared to the nine-month period in 2018. VDSC said it expected the larger players to face greater price competition while smaller companies stuck to their traditional clients, who offered low but sustainable margins. However, the bottom-line ratio tells the same story among all five companies, which is a slowdown in profitability. While CTD, PHGC and HTN seem to have a similar net margin of 3-4%, HBC’s net margin was heavily impacted by financial expenses, while PC1, again, took advantage of the electricity construction industry to keep a solid 7% net profit margin.