Vietnam’s economy shows encouraging signs: AMRO

The Government has been actively providing support for the economy, and the situation is expected to get better next year.

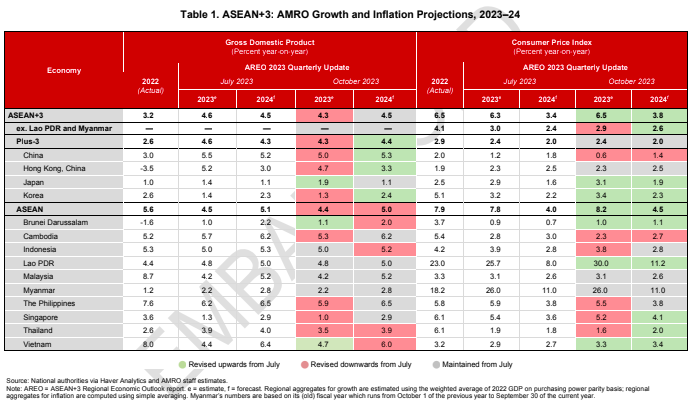

The ASEAN+3 Macroeconomic Research Office (AMRO) has revised Vietnam’s GDP growth forecast for 2023 to 4.7% from the previous 4.4% in its October quarterly update.

| Chief Economist Hoe Ee Khor (l) at the press briefing. |

“The recent numbers have shown more strength than we initially expected in July,” said AMRO Chief Economist Hoe Ee Khor during a press briefing held online today [October 4].

However, it's essential to note that this is still a significant decline from last year's 8% growth rate, which was among the highest in the world, he noted.

According to Khor, growth for the ASEAN+3 region (including China, Japan, and South Korea) is expected to be significantly impacted this year with an average rate of 4.3%, down from July’s projection of 4.6%, primarily due to challenges in the export sector.

“Most countries in the region rely heavily on manufacturing exports, and when external demand weakens, it can have a severe impact on their economies. Vietnam is no exception to this,” he said.

The expert suggested the Vietnamese economy is also facing challenges in its real estate sector, which is currently undergoing a correction phase.

“The real estate sector was booming until last year, but due to the pandemic, some segments have experienced a downturn, further affecting Vietnam's overall growth,” he noted.

Meanwhile, the inflation rate is expected to rise by 3.3%, well within the country’s 4% target.

Given the downward pressure on growth is expected to be mainly cyclical, driven by export challenges, Khor expects the situation to improve next year. “There are already signs of a rebound in exports. We expect Vietnam to grow by 6% next year,” he continued.

According to the economist, the Vietnamese Government has taken several measures to support the economy during the unfavorable context, including measures to reduce interest rates, increase credit facilities, and make significant rate cuts for small and medium-sized enterprises (SMEs), amounting to a 150-basis point reduction.

On the fiscal side, the Government has provided relief to enterprises by deferring tax payments. In the real estate sector, measures have been taken to assist developers in restructuring their loans.

| AMRO's ASEAN+3 growth forecast. |

“While the real estate sector's recovery may take more time, we believe the challenges facing the export sector are cyclical and (the situation) should improve next year. As a result, we do not see the need for the Vietnamese government to implement a large-scale stimulus approach, and we expect the economy to regain momentum as demand picks up,” he noted.

AMRO’s update for the region expects the average growth to expand by 4.5% in 2024, supported by the expected turnaround in manufacturing exports and improving growth momentum in China.

This, along with the gradual pick-up in durable goods consumption in the US and an expected rebound in the global technology cycle, should boost regional exports next year amid the expected weakness in the global economy.

“Despite the gloomy headlines surrounding China’s economic performance, we must view things in perspective,” added Khor. “Beyond the real estate sector, manufacturing investment is holding up and consumer spending is starting to get back on track—these should have positive spillover effects across the rest of ASEAN+3.”

Inflation in the ASEAN+3 region—excluding Lao and Myanmar—is forecast to moderate to 2.6% in 2024, down from this year’s estimate of 2.9%. However, the resurgence of global food and energy prices in recent months is sparking concerns of another commodity price spike, with the risk of higher inflation becoming more pronounced. “El Niño is the wild card for inflation, especially if it leads to additional restrictive trade policies on key agricultural imports such as rice,” Khor cautioned. “The impact of commodity prices on ASEAN+3 inflation will be sharper if the strength of the US dollar relative to the region’s currencies continues.”

AMRO also warns against fully discounting the risk of a recession in the US and the eurozone, especially in an environment where global interest rates could stay higher for longer. Should recession in both economies materialize, growth in the ASEAN+3 region could slide below 3%—the lowest since 1998, barring the pandemic-induced slowdown of 2020.