Vietnam’s e-commerce firms Tiki and Sendo rumored to engage in merging talks

The merging would create a stronger firm capable of rivaling regional players such as Lazada and Shopee in Vietnam’s retail market.

Vietnam’s two major e-commerce platforms Tiki and Sendo are reportedly holding exploratory talks to merge with each other, according to Deal Street Asia.

As of present, both Tiki and Sendo have not commented on this issue. In case the deal materializes, the merging would create a stronger firm capable of rivaling regional players such as Alibaba-backed Lazada and Singapore-based SEA Limited’s arm Shopee in Vietnam’s retail market.

One of the key issues for e-commerce operators are financial capabilities, as most companies are suffering huge losses in operation. The trend is forecast to continue for foreseeable future as companies are trying to maintain their position in the market or risk being shown the door with empty hand.

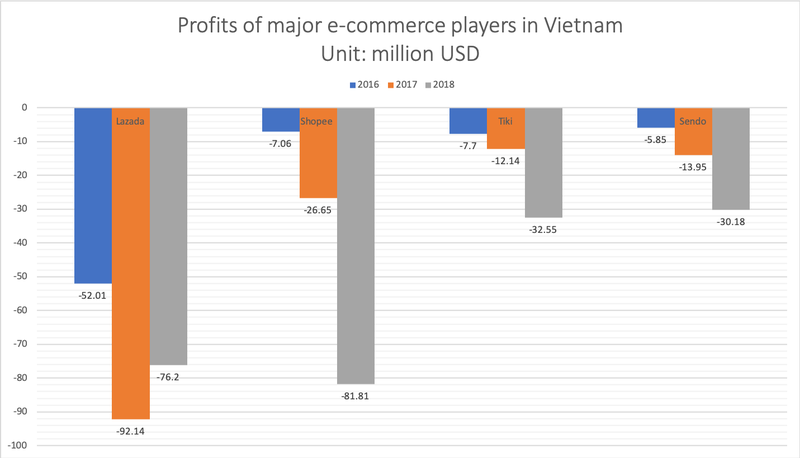

| Data: Cafef. Chart: Nguyen Tung. |

Data from Cafef showed in the 2015 – 2016 period, Lazada’s loss of VND1 trillion (US$43.04 million) per year surprised everyone in the market, but now the retail giant and its main competitor Shopee have pushed their respective losses to over VND2 trillion (US$86.1 million) per year.

In 2016, the average loss of the major four e-commerce players namely Lazada, Shopee, Tiki and Sendo was estimated at VND1.7 trillion (US$73.17 million). The figure doubled to VND3.4 trillion (US$146.36 million) in 2017 and then rose to VND5.1 trillion (US$219.5 million) in 2018.

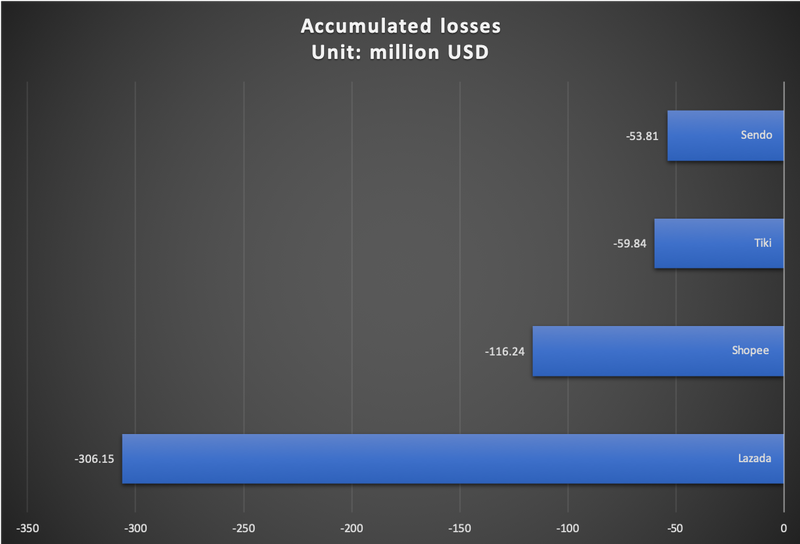

As of the end of 2018, accumulated loss of Tiki reached nearly VND1.4 trillion (US$59.84 million) and Sendo of VND1.3 trillion (US$53.81 million).

| Data: Cafef (as of December 31, 2018, except for Lazada until March 31, 2019). Chart: Nguyen Tung. |

With strong backing of Alibaba and SEA, both Lazada and Shopee only need to focus on operation and expanding market shares, while Tiki and Sendo have to constantly raise funds from investors to maintain operation.

Last November, Sendo secured US$61 million in a series C round – its largest raise to date. After the round, foreign investors now hold a 61.1% stake in Sendo. Local major IT firm FPT is the largest shareholder, along with SBI Group, Beenos, SoftBank Ventures Asia, Daiwa PI Partners, and Digital Garage, among others.

In a similar move, Tiki successfully raised funds in two respective rounds last June and December. Its major shareholders include VNG with a 24.6% stake and JD.com with 21.9%, while the latter poured US$50 million in Tiki through a series C round in 2018.

A recent research report by Google, Temasek and Bain named Vietnam as the most digital of all ASEAN’s economies with the gross merchandise value (GMV) of internet economy set to account for over 5% of the country’s GDP in 2019 or US$12 billion, recording a 38% annualized growth rate since 2015. The figure is projected to increase to US$43 billion by 2025.

In the internet economy, Vietnam’s e-commerce market is set to make a big leap from US$5 billion in GMV in 2015 to US$23 billion by 2025.

“e-Commerce is a key driver behind Vietnam’s impressive numbers, where homegrown marketplaces like Sendo and Tiki compete with regional players like Lazada and Shopee,” stated the report.