ASEAN’s post-pandemic opportunity

The Association of Southeast Asian Nations (ASEAN) governments need better coordination and closer integration to thrive in a post-Covid world and avoid a weaker and more protracted recovery.

That closer relationship is especially important in areas such as tourism, regional health infrastructure and supply chains.

Banding together to achieve better health infrastructure - particularly amongst the less developed members in the region - is an investment with large long-term payoffs. Inter-regional travel cannot take-off unless the outbreak is successfully contained within ASEAN.

Co-ordination

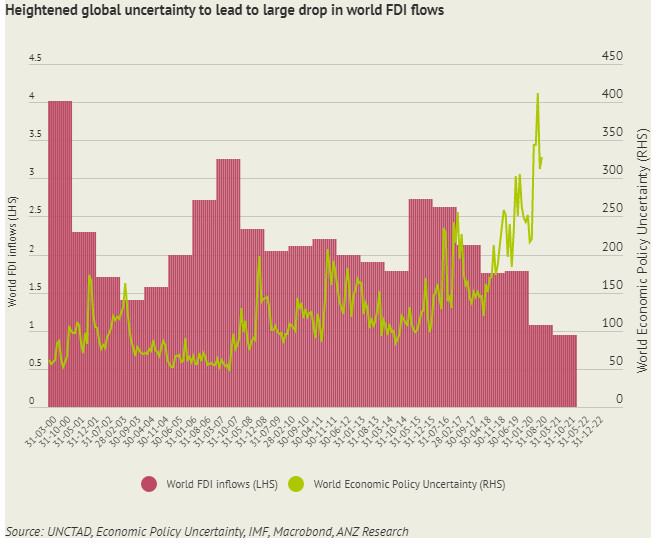

Stronger co-ordination of regional supply chain shifts is another area where co-operation rather than competition will result in better overall outcomes. The United Nations Conference on Trade and Development (UNCTAD) forecasts global foreign direct investment (FDI) flows will plunge as much as 40 per cent in 2020 and up to 10 per cent in 2021.

Naturally, it is tempting for each country to go at it alone to try and attract as much FDI as it can. But in an environment where supply chain resilience and security of supply is taking precedence over efficiency, ASEAN is better off working together to make the region an attractive destination as a whole.

Harmonising standards and regulations, rather than allowing multinationals to gain from regulatory arbitrage and favourable concessions, will ultimately lead to better allocation of capital.

Quantitative easing

Quick action by policymakers to provide both fiscal and monetary support to their economies helped to cushion even larger blows to ASEAN’s economy.

In addition, the massive stimulus provided by the US Federal Reserve played a huge role in stabilising financial markets in the region. Through committing to unlimited quantitative easing and establishing a new facility for emerging markets to access dollars, this helped ensure sufficient dollar liquidity for emerging markets.

This is why we are not facing a financial crisis at this point.

But there is a danger a solvency crisis will emerge. If economic activity does not recover sufficiently before government support measures expire, this will cause business failures to spike and lead to more job losses.

Long drawn

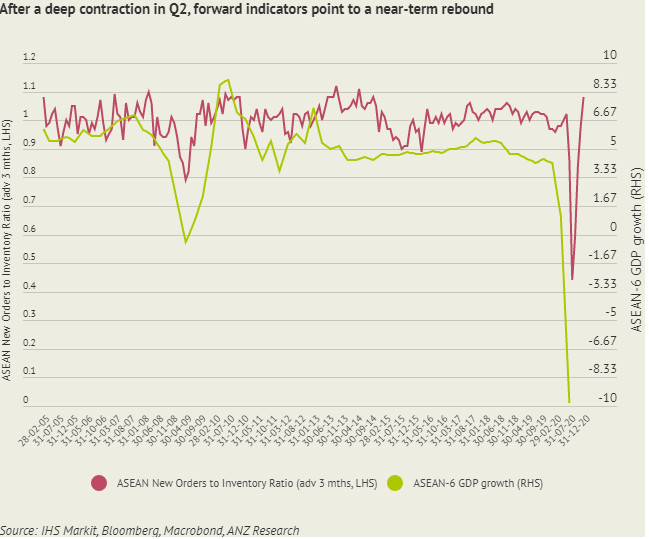

There are signs the worst of the economic contraction is now behind us. Strict restrictions have eased, allowing businesses to re-open. Mobility trends have shown an improvement since late April or early May, the low point for activity. Manufacturing PMI data for the region, a good indicator for growth, is pointing towards a rebound.

Externally, global trade is starting to improve after the sharp decline over the first half of the year. This should start to be reflected in ASEAN’s export numbers in the coming months.

The economic recovery though will be a bumpy and long drawn out affair, given the second and third waves of outbreaks experienced in some countries. In the Philippines and Indonesia for example, the situation is still far from contained. By ANZ Research’s estimates, ASEAN’s real gross domestic product (GDP) will only recover to pre-Covid-19 levels in late 2021 or early 2022 at the earliest.

So far, most governments have adopted a unilateral approach to combating the pandemic, due to the lack of global leadership amongst the major advanced economies.

Integration

The pandemic has resulted in unprecedented public borrowing among governments right around the world as they battle the health crisis and ensuing economic fall-out. But governments need to come up with a credible medium-term plan to repair the fiscal position at some point or risk losing support from credit rating agencies and investors.

The US Federal Reserve’s commitment to keep interest rates low for a long time provides ASEAN with much needed breathing space. However ultra-accommodative US monetary policy, and the Fed's increased tolerance for higher inflation in the US, has resulted in further pressure on the US dollar. In turn, this has resulted in the strengthening of currencies in ASEAN which has eroded the grouping’s export competitiveness.

In addition, long periods of low interest rates also risk inflating asset prices which could cause financial stability risks. How policymakers manage this in a world awash with liquidity is important.

Ongoing tensions between the United States and China have raised fears the era of globalisation is over. Increased nationalism is understandable but going it alone is self-defeating. A country cannot thrive if it is successful in containing the outbreak while its neighbours are not. There is a vested interest in ensuring that the pandemic is contained everywhere.

Covid-19 has brought about huge structural shifts. ASEAN has largely adopted unilateral measures to manage the pandemic and the economic fallout but better coordination and closer integration is crucial for the region to not only to recover but thrive.

In this regard, a successful conclusion to the Regional Comprehensive Economic Partnership (RCEP) by the end of the year will send a strong signal ASEAN remains committed to multilateralism while serving to kick-start recovery prospects in the region.

More than ever in a post-pandemic world, ASEAN remains poised to be greater than the sum of its parts.

Khoon Goh is Head of Asia Research at ANZ

This article was originally published by the Business Times.