Predicted consumer resets to shape Vietnam FMCG market: Nielsen

The news cycle related to Covid-19 transmission no longer influences trends on the FMCG market in Vietnam and Southeast Asia.

Four predicted consumer resets will shape the Southeast Asian (SEA) and Vietnam fast-moving consumer goods (FMCG) market in the future, according to the latest study by Nielsen, the market research company.

| Photo: Kinh te & Do thi |

A new Nielsen study indicates that the basket, homebody, rationale and affordability reset underpinned by worsening unemployment situations and uncertain financial prospects in Southeast Asia, are the new drivers of consumption patterns.

The study presents how behavioral responses could differ according to the circumstances and level of personal impact the pandemic has had on consumers. Across Asia nearly two out of every five consumers (38%) said they have been impacted by Covid-19, versus 32% globally.

Homebody reset

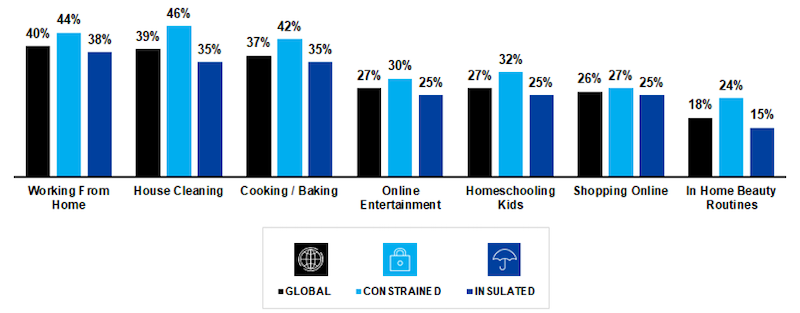

Another consumer shift that Nielsen predicts will reshape FMCG markets is the evolving routines of consumers at home. ‘Do-it-yourself’ (DIY) behaviors and demand for in-home branded experiences have persisted even beyond living restrictions and store re-openings in many Southeast Asian markets.

In Vietnam, 82% consumers said to reduce out-of-home consumption occasion, corresponding to heightened sales of instant noodles (up by 14.1% vs last year), sterilized sausage (17.9%), meal maker (7.4%) and mayonnaise (31.0%).

Percentage of respondents who added DIY activities to their normal routine than pre-Covid-19 outbreak

| Source: Nielsen Global Survey “The New Shopper Normal”, May 2020 |

“Companies that can intelligently align with DIY behaviors will succeed in empathizing with current consumer interest in creative, cost-conscious and safe consumption. Consumers are already willing to do the legwork to bring a product experience into the safety of their homes,” said Nguyen Anh Dzung, head of Retail Measurement and Retailer Vertical, Nielsen Vietnam. “Therefore, companies have the opportunity to seize that interest and respond with affordable, accessible and branded take-home experiences.”

Affordability reset

With less disposable income in their pockets, consumers will search for ways to optimize their basket spend to prioritize both health and value needs.

Nielsen has observed a historically low level of trade promotion activity across various countries. Channel preferences are also shifting as the criteria for affordability evolves in the minds of consumers.

In Vietnam, Modern Trade channel posted positive sales growth in June (up 13% in value sales against last year) with the number of stores on constant rise (up 35% stores in June 2020 versus June 2019), driven by Minimarts format (up 51% stores in June 2020 vs June 2019).