Vietnam bond market contracts 1.7% to US$58.2 billion in H1: ADB

This is mainly due to lower outstanding debt in the government sector, even though the corporate bond stock increased.

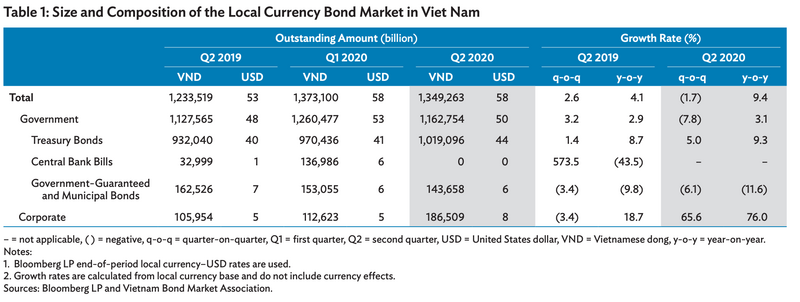

Vietnam’s local currency bond market contracted by 1.7% as of the end of June this year to reach US$58.2 billion, after posting healthy 10.4% quarterly growth in the first quarter, according to the latest edition of the Asian Development Bank (ADB)’s Asia Bond Monitor.

On an annual basis, the bond market expanded 9.4% year-on-year in the second quarter of 2020, although this was slower compared to the previous ones.

The quarterly contraction in market size was due to lower outstanding debt in the government sector even as the corporate bond stock increased. Government bonds accounted for a larger share of Viet Nam’s bond market at 86.2% versus corporate bonds with a 13.8% share.

Total yields of local currency (LCY) of government outstanding bonds in Viet Nam decreased 7.8% quarter on quarter to VND1,163 trillion (US$50.26 billion) at the end of June.

The absence of outstanding central bank bills was one of the main drivers of the decline. Outstanding central bank bills matured in the second quarter from VND137 trillion (US$5.92 billion) in the previous quarter, while there was no new issuance from the State Bank of Vietnam (SBV) to support liquidity in the market.

The low-interest-rate environment has also been conducive for the State Treasury to accelerate fund mobilization to support the government’s fiscal stimulus measures against the adverse economic impact of the Covid-19 pandemic. Despite low yields, Treasury bonds’ attractiveness to investors reflects portfolio diversification to include safe-haven assets amid the pandemic and also indicates confidence in Viet Nam’s economic prospects.

Corporate bonds posted growth of 65.6% quarter-on-quarter and 76.0% year-on-year in the second quarter, bringing the total outstanding amount to VND187 trillion (US$8.1 billion) at the end of June.

At the same time, corporates were active in mobilizing funds through bond issuance during the quarter as they reopened operations after pandemic restrictions were lifted. Also, an upcoming regulation that will raise the standards in the corporate bond market and result to stricter issuance guidelines made issuers rush to the bond market before it becomes effective on September 1.

The aggregate bonds outstanding of the top 30 corporate issuers amounted to VND147.1 trillion (US$6.36 billion), or 78.9% of the total corporate bond market, at the end of June. Meanwhile, the majority were largely from the banking industry with cumulative outstanding bonds equal to VND62.7 trillion (US$2.71 billion) or nearly half of the top 30’s outstanding debt.

In emerging East Asia, the report suggested Improving global investment sentiment and financial conditions provided a much-needed lift for local currency bond markets, despite risks from the Covid-19 pandemic.

“Governments in the region have been agile in dealing with the impact of the Covid-19 pandemic through a wide range of policy responses, including monetary easing and fiscal stimulus,” said ADB Chief Economist Yasuyuki Sawada. “It is crucial that governments and central banks maintain accommodative monetary policy stances and ensure sufficient liquidity to support financial stability and economic recovery.”

The region’s government bonds outstanding reached US$10.5 trillion at the end of June and accounted for 60.8% of the region’s aggregate bond stock. Corporate bonds, meanwhile, totaled US$6.7 trillion.