Vietnam budget deficit forecast at 3.6% of GDP in 2021

Fitch Solutions holds a more optimistic view on Vietnam’s economic rebound in 2021, with its real GDP growth forecast at 8.6%, against the government’s 6.5% target.

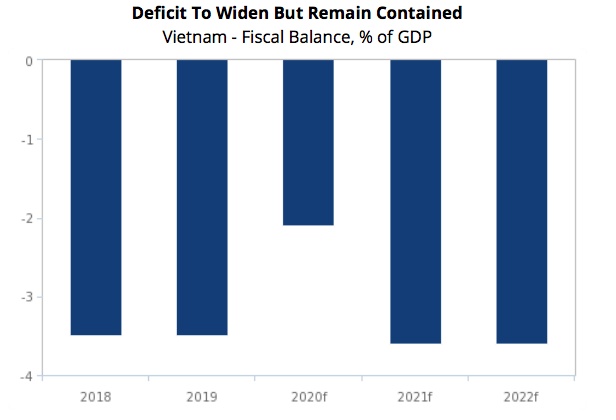

Fitch Solutions, a subsidiary of Fitch Group, forecasts Vietnam’s budget deficit (excluding debt payment) in 2021 at 3.6% of GDP, which is lower than the government’s estimation of 4.0% released in October 2020.

“Our forecast rests on our view that revenue collection in 2021 is set to record strong growth supported by robust economic growth,” states Fitch Solutions in a note, adding this would more than offset any increase in government expenditure as the central government continues to aim to expedite the disbursement of development capital.

Factoring the latest data from the statistical office’s December 2020 data release which estimated the budget outturn up to December 15, 2020, Fitch Solutions estimates the 2020 budget deficit (excluding debt repayment) to be 2.1% of GDP, much lower versus its earlier estimate of 3.6%.

| Source: Ministry of Finance, Fitch Solutions. |

“This was mainly the result of expenditures coming in weaker against the government’s budgeted figures versus revenues,” it addes.

According to the GSO’s release, total state budget revenue up until December 15, 2020 was estimated at VND1,307.4 trillion (US$56.7 billion or 86.5% of the budget estimate), while total state budget expenditures for the same period were estimated at VND1,432.5 trillion (US$62.02 billion or 82% of the budget estimate). This would result in a deficit of VND129 trillion (US$5.58 billion).

Multiple tailwinds lead to higher budget revenue

Meanwhile, Fitch Solutions expects Vietnam to record a 5.9% increase in total state budget revenues (and grants) in 2021.

The agency holds a more optimistic view on Vietnam’s economic rebound in 2021, with its real GDP growth forecast at 8.6%, against the government’s 6.5% target.

“Multiple tailwinds arising from higher trade volumes, higher global oil prices, and increased domestic economic activity, will be supportive of a strong revenue outlook for trade-related revenues, crude oil related revenues, and domestic revenue collection, respectively,” asserts Fitch Solutions.

Effective policies to contain the outbreak will also give investors more confidence to set up operations in Vietnam, given less risk of prolonged business disruption.

Fitch Solutions believes that this will add another push to the ongoing wave of manufacturing relocation to Vietnam, which will in turn boost the domestic economy and drive trade volumes higher. The global vaccine rollout should also bode well for sustained strong external demand in 2021 for Vietnamese exports, with external demand also supported by trade pacts such as the EU-Vietnam Free Trade Agreement (FTA), the UK-Vietnam FTA, and the Regional Comprehensive Economic Partnership.

On the contrary, Fitch Solutions forecasts a 14.2% increase in total state budget expenditures in 2021.

Public fund disbursements were held back due to many challenges in 2020, notwithstanding lockdowns and disruptions from the pandemic which caused delays in the import of capital equipment and foreign project advisors.

Other challenges were difficulties in site clearance and resettlement due to inability for local authorities and landowners to come to an agreement on land handover for project execution, and adjustments to financing agreements and investment procedures of overseas developmental assistance (ODA)-funded projects causing delays in construction.

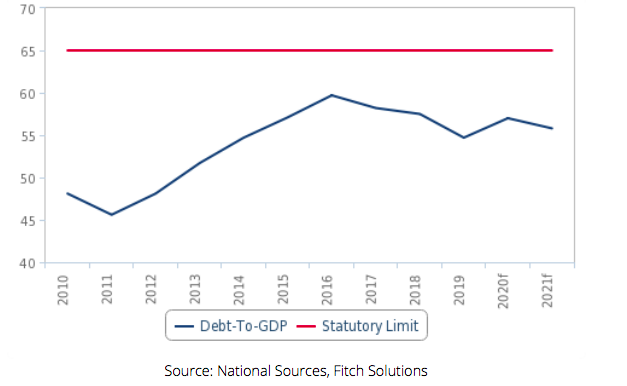

Well Under The 65% Statutory Limit Vietnam – Public Debt, % of GDP |

“While many parts of the world are still grappling with a resurgence in Covid-19 infections, we believe that the global vaccine rollout should help to flatten the infection curve and also facilitate trade activity as containment measures are eased, alleviating external factors holding up fund disbursement.”

“Domestic challenges, especially in land agreements, will likely remain,” states Fitch Solutions.

However, Fitch Solutions expects smoother progress on ODA projects in 2021, and with that, public fund disbursements as these adjustments are agreed upon and projects are implemented.

“The prime minister’s seven task forces set up to hasten the disbursement of public funds should also go some way to ensure better implementation of the government’s targeted amount for the year,” it concluded.

Given a strong economic growth in 2021, Fitch Solutions predicts Vietnam’s public-debt-to-GDP ratio to 55.8%, well below the government’s statutory limit of 65%, which is lower than the estimated 57% in 2020.