Vietnam likely to average GDP growth of 7% in 2021 – 2025: NCIF

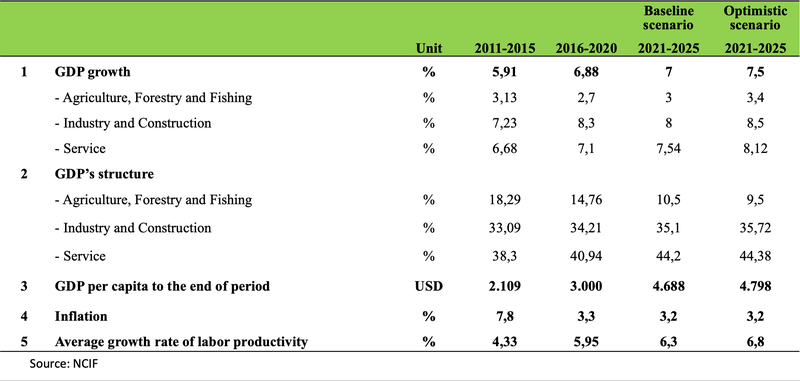

An average GDP growth rate of 7% in the 2021 – 2025 period would translate in income per capita of US$4,688, taking Vietnam to the bracket of high-middle income country.

Vietnam’s average GDP growth in the 2021 – 2025 period is forecast at 7%, leading to income per capita of US$4,688 during the period, significantly higher than the figure of US$3,000 in 2016 – 2020, according to Dang Duc Anh, vice director of the National Center For Socio-Economic Information and Forecast (NCIF).

| Overview of the workshop. Source: Ngoc Thuy. |

“Such figure would put Vietnam in the bracket of high-middle income country,” Anh referred to one of two scenarios developed by the NCIF for Vietnam’s economy that is more likely to happen at the workshop discussing the country’s economic outlook for 2021 – 2025 held on November 21.

Other key economic indicators include inflation forecast at 3.2% and average growth rate of labor productivity at 6.3% during the period.

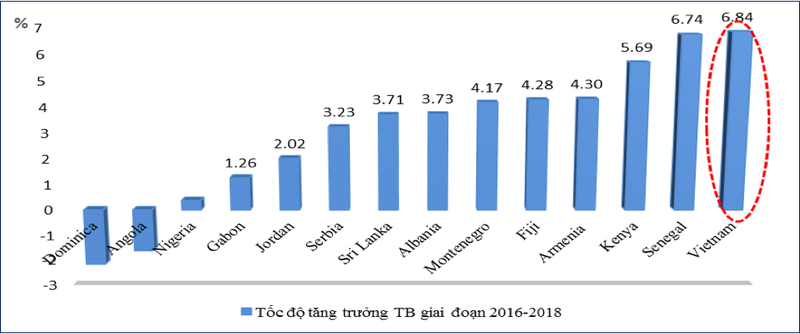

| Vietnam's GDP growth compared to some countries with the same macro stability rating in the period 2016-2019. Source: NCIF. |

Anh expected services and construction, information technology, wholesale and retail, would be growth drivers in the 2021 – 2015.

The forecast came in on the back of strong economic growth recorded in 2017 – 2019 with GDP growing 6.81%, 7.08% and 7.1%, respectively. The positive performance was encouraging, particularly in the context that growth of the world economy and most countries slowed down, added Anh.

Overall, Vietnam’s economy in the 2016 – 2020 period has achieved many positive results, including the average GDP growth rate of 6.84% that is in line with the target of 6.5 – 7%. However, it contained many risks and limitations, said Anh.

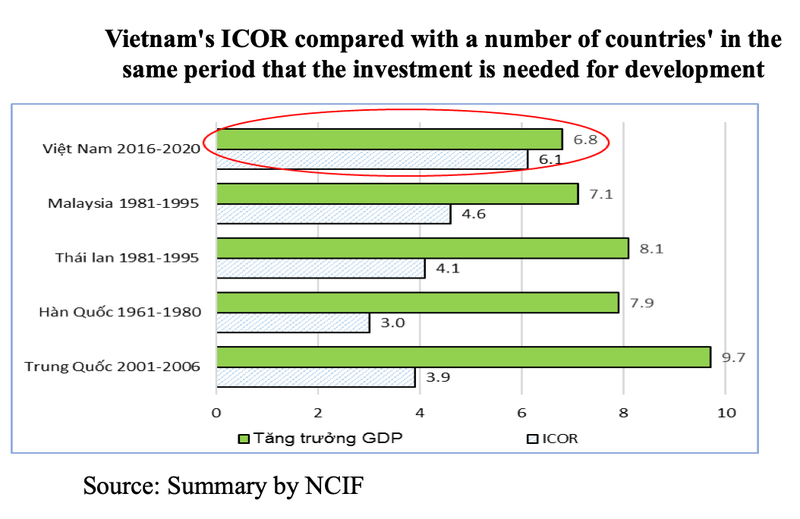

According to the NCIF report, Vietnam’s economic growth in the period of 2016 – 2020 was accelerated by the improvement of productivity and efficiency, with higher labor productivity, and improved investment efficiency than in previous years.

Specifically, the average productivity grew 5.8%, higher than the figure of 4.3% in the 2011 – 2015, while the incremental capital – output ratio (ICOR), a measure of the inefficiency with which capital is used, was 6.11%, lower than the figure of 6.25% of the previous 5-year period.

The NCIF, nevertheless, said the growth model of the 2016 – 2020 period has not changed significantly. Growth is still largely dependent on capital (investment capital/GDP is still high, an average of 33.5%), the contribution of the capital factor in growth still accounts for a large proportion (over 55%).

The economic structure has shifted too quickly into the service sector while the industrial base is weak. Supporting industry is underdeveloped, processing still accounts for a major portion. The contribution of high added value services is still low, and logistics costs remain high, stated the NCIF’s report.

Notably, exports continue to depend on commodity groups made by FDI enterprises. Export turnover increased but the domestic content of exports did not increase correspondingly. Domestic enterprises, especially small and medium enterprises (SMEs), have not participated actively in the global value chain.

Innovation capacity has not been improved much and is still a bottleneck in Vietnam's economic development while the 4.0 Industry is happening strongly in the world.

| Economic growth scenarios 2021 - 2025. |

Next generation FTAs as new growth engines

Tran Toan Thang, head of the World Economic Department at the NCIF, said Vietnam’s participation in next generation free trade agreements (FTAs), especially the Comprehensive Progressive and Trans – Pacific Partnership (CPTPP) and the EU – Vietnam Free Trade Agreement (EVFTA), would have significant impacts on Vietnam’s economy in the 2021 – 2025 period.

By 2030, the EVFTA and the CPTPP are expected to boost Vietnam’s GDP by 4.3% and 1.3%, respectively, while Vietnam’s exports to EU by that time is estimated to grow by 44.4% and to countries in CPTPP at 14.3% by 2035.

Additionally, Thang expected these two agreements would help increase the investment flow to Vietnam, so that foreign companies could better penetrate markets of Vietnam’s partners.

“Another aspect is greater investment in upstream industries in order to exploit the commitment of origin ratio, which in turn improves Vietnam’s supply chain,” Thang added.