Vietnamese upbeat on end to COVID-19, but worry about finances

The survey shows that many Vietnamese people, especially single women, have clearly experienced challenges during the pandemic, but many have adapted and taken control by actively managing their own finances.

HO CHI MINH CITY – Two years on from the outbreak of COVID-19, people in Vietnam believe the end is now in sight and that they are in good shape health-wise, but concerns around personal finances remain, particularly among single women, according to new research from Manulife.

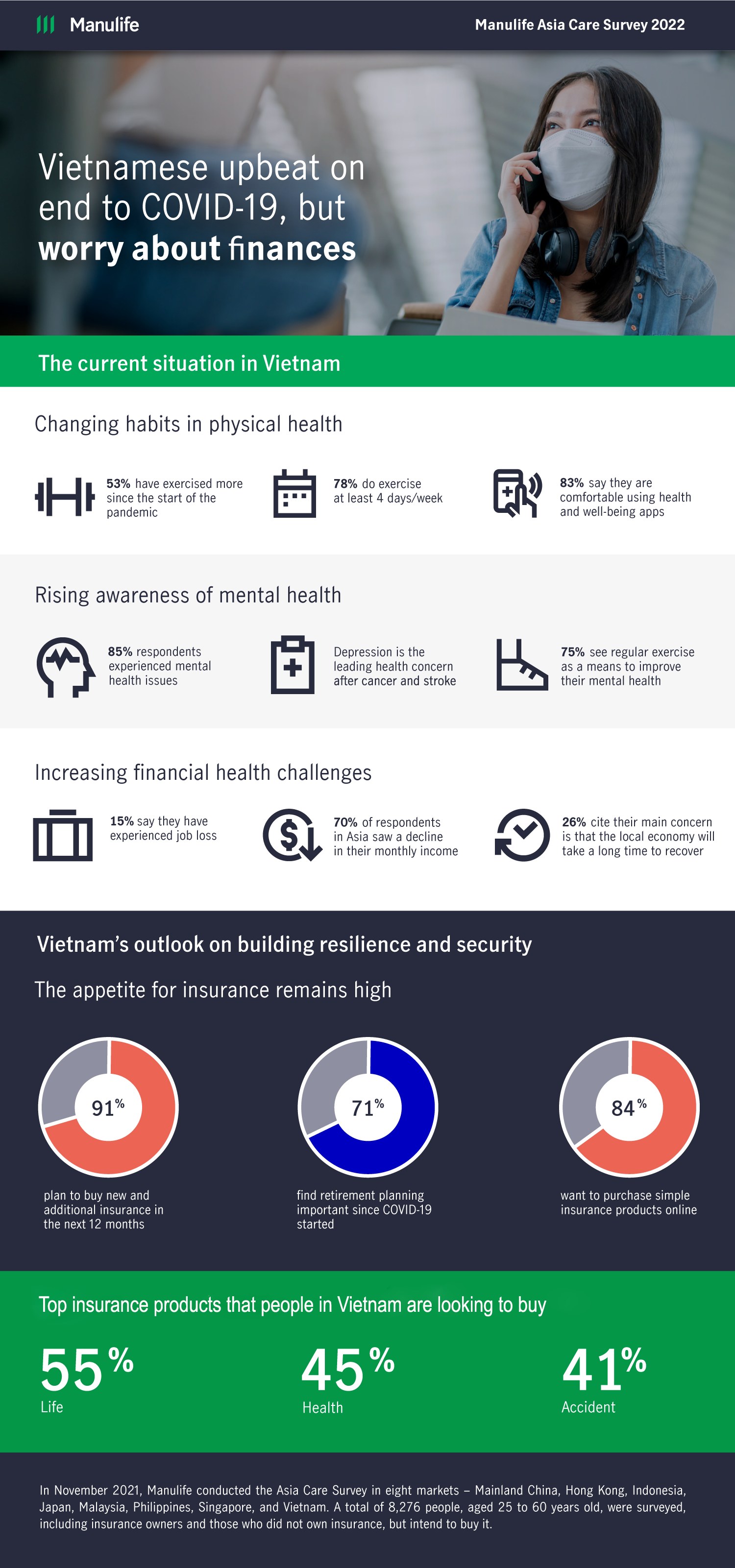

Among those in Vietnam surveyed as part of Manulife’s third Asia Care Survey, more than two thirds (69%) said it will be gone within a year, with 77% expecting COVID-19 restrictions would be lifted within that timeframe. They have the most optimistic outlook in the region, which extends to concerns about the time it will take for the local economy to recover – just a quarter (26%) are worried it will take a long time, the lowest in the region. The survey was carried out just as the Omicron variant was starting to spread.

Despite their more sanguine outlook, 15% said they have experienced job loss, while 70% said their income has fallen as a result of COVID-19. In addition, only 19% of single women have savings on hand to last longer than a year, well below the 33% national average. The findings also show that three-quarters (75%) of single women are struggling to cope with COVID-19.

“Vietnamese people, especially single women, have clearly experienced challenges during the pandemic, but many have adapted and taken control by actively managing their own finances,” said Sang Lee, Chief Executive Officer, Manulife Vietnam. “What’s also good is that they are taking more care of their own health and protection. That includes insurance. At Manulife, we work with and listen closely to our customers, as well as look at the broader market environment. This helps us to shape our products to better meet our customer’s needs.”

Given that a quarter (26%) expressed concern about their family catching COVID-19, it is noteworthy that 86% said they recognized the importance of insurance – way higher than the regional average (69%) – and the importance of retirement planning (71%). The survey also showed that a third (34%) of the respondents saw insurance as a means to mitigate against COVID-19-related financial impact. Other survey responses showed Vietnamese cutting back on unnecessary expenses (24%) and, to help make up the drop in income, set up their own businesses (26%). Working mums were a standout here, with about a third (30%) saying they had launched their own business.

Despite low insurance penetration rates in Vietnam, of those surveyed, 72% owned insurance – the most popular being health (47%), life (42%) and accident (38%). Remarkably, 91% said they plan to purchase insurance in the next 12 months, with life (55%), health (45%) and accident (41%) being at the top of the list. When buying insurance, the majority of Vietnamese (84%) are also looking for simple insurance products that they can buy online. For monitoring health status, 83% of Vietnamese surveyed said they are comfortable using health and well-being apps.

Addressing the growing demand for health protection and the rising costs of critical illness and medical care in the new normal, Manulife Vietnam recently launched a new generation of supplementary insurance products. The Critical Illness Plus Rider and Medicash Plus Rider deliver pioneering solutions in the market with their best-in-class features, including extending entry age for both riders up to 69 years as well as protection benefits for up to 85 years. In addition, the Safety Net Benefit pays out claims for customers based on certain criteria for treatment or surgery without having to meet the disease definition.

“The pandemic continues to further highlight the value of life insurance protection in the community, with safeguarding health remaining top of mind in Vietnam. During a crisis ruled by unfamiliarity and uncertainty, we’re proud of the stability, affordability and confidence we’ve instilled in the community through our products and services,” added Mr Lee.

People in Vietnam are staying healthy, but mental health concerns remain

Much of their thinking about insurance ties back to health. On this, Vietnamese people are trying to better manage matters too. They are among the most physically active (69%) in the region. More than half (53%) have increased their exercise since the outbreak of the pandemic, with 55% exercising every day and 78% doing so at least four days a week – they are by far the biggest fitness enthusiasts in the region.

In terms of their main health concerns, Vietnamese respondents cited cancer (43%), stroke (40%) and depression (26%). Single women again stood out, in this instance with regard to mental health issues. A high 94% of them said they have experienced mental health issues, with 40% saying are concerned about depression.

“In Vietnam, we see a greater focus on financial planning and also the people have a good sense of the broader issues, along with the value of healthy lifestyle,” said Marilyn Wang, Chief Marketing Officer for Manulife Vietnam. “Their awareness of Long COVID is the highest in the region, which is impressive because it means they can be better prepared and proactively seek out protection for themselves and their families.”

Awareness of Long Covid high in Vietnam

According to the World Health Organisation, around a quarter of people who have had the virus experience symptoms that continue for at least a month, but one in ten still feel unwell after 12 weeks. The symptoms which have been generally described as “Long COVID” can seriously impact people’s ability to return to work or have a social life.

While four in five said they are aware of Long COVID, 98% said they are worried about it, with 65% saying they are very worried. Almost all (98%) of the respondents want to learn more about it. For most, the main questions are how to avoid catching it (66%) and what are the remedies (60%). Another big question for 58% of the respondents is what kind of health and care support is available to deal with the condition. Nearly half (46%) want to know how insurance can help them. A key area of focus for Manulife is empowering sustained health and wellbeing.

“The survey findings provide some valuable insights on customer thinking and their concerns, which are important for us to know for product planning and service enhancements,” added Ms. Wang. “With our industry-leading health products and innovative customer program ManulifeMOVE, we try to nudge our customers to stay active by rewarding every step they take to make their lives better every day.”