Vietnam’s consumer prices up 4.19% in Jan-Jun, highest in 5 years

Core inflation in the first six months of 2020 rose by 2.81% year-on-year.

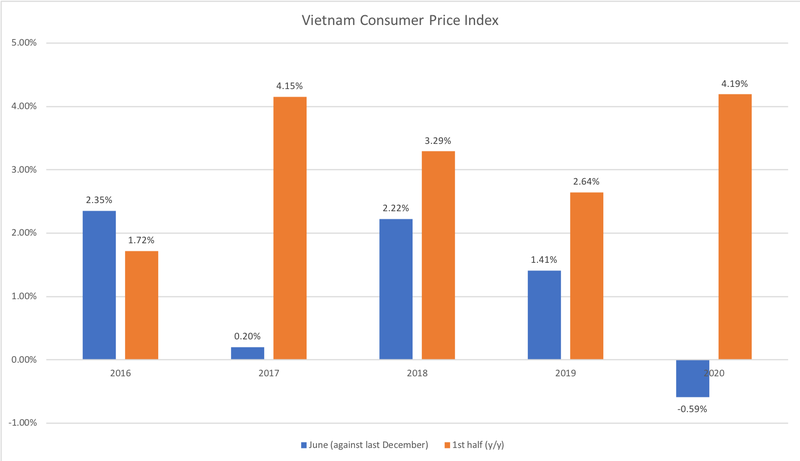

The consumer price index (CPI), the main gauge of inflation, expanded 4.19% year-on-year in the first half of 2020, the highest six-month growth rate during the 2016 – 2020 period, according to the General Statistics Office (GSO).

| Data: GSO. Chart: Hai Yen. |

Meanwhile, the country’s CPI in May saw an increase of 0.66% against the previous month, mainly due to three price hikes of petroleum products and high pork prices. The rate, however, declined by 0.59% versus last December, which is the lowest in the 2016 – 2019 period.

Seven out of 11 commodity groups, which are items of the basket for CPI calculation, witnessed month-on-month hikes in prices. Among them, transportation posted the sharpest increase.

Vietnam’s CPI in the second quarter declined by 1.87% quarter-on-quarter and was up 2.83% year-on-year.

According to the GSO, core inflation in the first six months of 2020 rose by 2.81% year-on-year.

The government aims to control inflation at 4% this year, the same as in 2019.

Fiscal deficit expands to nearly US$3 billion

Vietnam recorded a state budget deficit of VND69.1 trillion (US$2.96 billion) in the year to June 15, 2020, a stark contrast from a budget surplus of VN48.1 trillion (US$2.06 billion) in the same period last year.

Year to June 15, budget revenue collection reached VND607.1 trillion (US$26.05 billion), equivalent to 40.1% of the year's estimate. Upon breaking down, domestic revenue during the period stood at VND503.8 trillion (US$21.62 billion), equivalent to 39.9% of the year's plan.

Revenue from import-export activities hit VND82.8 trillion (US$3.55 billion), or 39.8% of the year's estimate, and that from crude oil totaled VND20.2 trillion (US$866.91 million), meeting 57.5% of the year's plan.

Meanwhile, state budget expenditures as of June 15 totaled VND676.2 (US$29.02 billion), equivalent to 38.7% of the year's plan. Of the total, regular spending reached VND475.1 trillion (US$20.38 billion) or 45% of the plan. Capital expenditure reached VND140.3 trillion (US$6.02 billion) or 29.8%, and interest payment, VND56.4 trillion (US$2.42 billion) or 47.8%.