Corporate bonds of real estate - risky commercial debt for investors

When enterprises fail to realize their commitment of interest payment, investors would be on the losing side.

Lack of attention from regulators has resulted in the market being flooded with corporate bonds of three Nos: no credibility rating, no guarantee asset, and no payment guarantee, according to economist Dinh The Hien.

Hien made such comments when there has been a growing trend of real estate firms issuing corporate bonds with high interest rates to attract investors - which is currently seen as one of the fastest ways to raise fund in Vietnam.

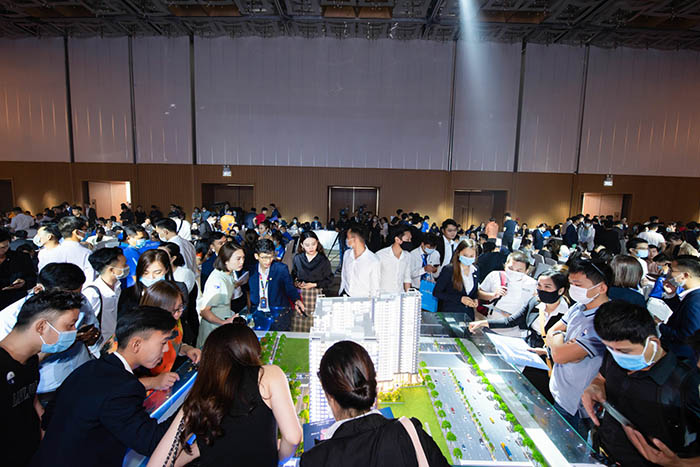

| Corporate bonds from real estate firms remain a risky business for investors. Photo: Tieu Thuy |

For the banking sector and other fields, corporate bonds are offered with interest rates of 7-8% per annum, but real estate firms coming up with much higher rate of 11-13%, or even 18% in some case.

“For this chaos, the loser would ultimately be investors,” Hien told Hanoitimes.

“Without guarantee asset, corporate bond is actually a debt note, while enterprises’ payment capability is dependent on their operation efficiency and financial status,” Hien added.

These bonds, estimated at VND120 trillion (US$5.23 billion) in 2020, or 65.6 of the totals, are not guaranteed and pose major risks for investors.

For corporate bonds associated with stock guarantee, Hien said it still remains risky for investors as in a crisis situation, all these stock value would go downhill in no time.

“Corporate bond is not for individual investors, as they are often issued for long-term of up to five years, and investors could not withdraw in case of urgency,” Hien stated.

“When enterprises fail to realize their commitment of interest payment, investors would be on the losing side.”

Vu Duc Thanh, an individual investor at District 2, Ho Chi Minh City, told Hanoitimes of his purchase of corporate bonds from a property development firm worth VND8 billion (US$350,000) five months ago.

“This enterprise is now unable to pay the interest rate, and for us, we cannot withdraw out money,” Thanh said.

A report from SSI Research revealed in 2019, real estate firms mobilized a total of VND57 trillion (US$2.48 billion) via corporate bonds issuance and accounted for 19.25% of total value in the market.

However, the figure for the first two quarters of 2020 was equivalent to 80% of total amount for 2019, of which corporate bonds without asset or stock guarantee stood at nearly VND63 trillion (US$2.74 billion), or 34.5% of total bonds issued.

Last September, Apec Group, owner of real estate projects in cooperation with US-based Wyndham, offer their corporate bonds with interest rate of 18% per annum. Other firms also provide their respective bonds with attractive rates, including TNR Holdings (10.9%), Sunshine Group (11%), or Van Don Tourism Development and Investment (10.5%).

Chairman of the Ho Chi Minh City Real Estate Association (HoREA) Le Hoang Chau said such high interest rates are kind of “bait” from bond issuers to convince investors to put their money on.

“Even firms issuing bonds with guarantee assets being future projects are already risky enough, it is needless to say regarding those without any guarantee at all,” he said, adding investors that only go for high interest rates would be at huge risk.

Banking expert Nguyen Tri Hieu told Hanoitimes said along with stronger measures from competent authorities to ensure healthy development of the bond market, a secondary market for corporate bond is needed to boost bond’s liquidity.

“Profit for investors at that time would not only come from interest rates, but also from the difference between selling and buying prices of bonds in the secondary market,” he noted.