Global providers’ expansion plans make Hanoi coworking supply rise

The Vietnamese coworking market is growing exponentially as more and more people become aware of the benefits this niche brings from a business and productivity point of view.

This year, Hanoi coworking supply is predicted to rise due to the continuing high demand as global providers will expand their locations in Vietnam during the next few years.

According to a latest related report on Vietnam's office market, global providers The Hive and Compass offices stated their intention to expand businesses, seeking valuable consolidation opportunities and partnerships.

| One of Toong's coworking locations. Photo: Toong |

Numerous providers expand rapidly

The Market Insight Report “Coworking & Flexible Workspace in Vietnam 2022” conducted by Acclime Vietnam supported by Knight Frank showed that as the market growth rate of flexible workspace develops sustainably, numerous providers have emerged in the sector and expanded rapidly.

Alongside well-established local providers such as Dreamplex, UPGen, cirCO, and Toong who have aggregated their brand with local communities, foreign brands Regus, The Executive Center, and Wework account for an increasing proportion of the market, with several locations in central areas like Ho Chi Minh City and Hanoi and future expansion plans on the table.

“Hanoi is the second-largest economic center in Vietnam, where the percentage of coworking space supply in the city is 6% of the total office space supply. Most coworking spaces are located in grade A & B buildings which provide occupiers with elite workspaces and a highly professional atmosphere,” the report noted.

UPGen, Regus, and Toong are some of the most prominent spaces in the Hanoi market with contribution up to 32%, 13%, and 12%, respectively.

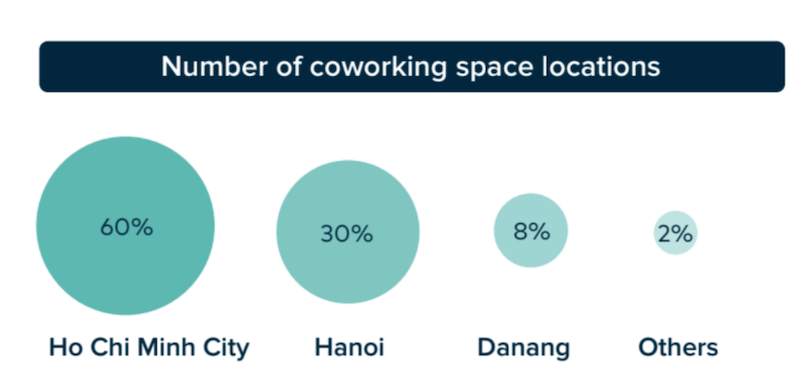

| Source: Acclime Vietnam |

According to Acclime Vietnam, part of Acclime Group - a corporate services provider in Asia, the flexible workspace market in Vietnam has experienced significant expansion, especially in central hubs such as Ho Chi Minh City and Hanoi.

This development has made the sector highly attractive to international providers across the world, which view Vietnam as a fecund business market, expecting high returns with relatively low risk.

Between 2020 and 2022, the pandemic has halted the expansion plans of foreign investors, however existing players in the Vietnamese market represented by flexible workspace brands such as WeWork, The Hive, cirCO, Toong, Dreamplex, and UPGen have been solidifying their coverage in Ho Chi Minh City and Hanoi.

The report revealed this trend is seen to increase further in 2022 due to the high market growth rate, demand drivers and also because of the structural mindset shift started by the Covid-19 pandemic, which pushed companies not just towards swift digital transformation adoption, but also made them view employee engagement and flexible work communication as key productivity assets.

Large enterprises - key demand driver

Most coworking spaces and serviced offices in Vietnam are located in metropolitan areas such as Hanoi with 64 locations, Danang with 18 and Ho Chi Minh City 97 locations.

Since becoming an alternative option to traditional office needs from 2016 until now, coworking is expected to grow alongside the traditional office market due to high demand from enterprises. Along with Ho Chi Minh City, coworking space supply in A & B buildings in Hanoi has also grown from 27,896 to 53,037 square meters during 2017-2020.

| A coworking location of UPGen. Photo: UPGen |

In 2021, aside from freelancers and SMEs who already represent a considerable percentage of the occupiers in flexible workspace locations across Vietnam, the demand from large enterprises is growing as they push towards digital transformation and adopt a lean approach towards employee engagement and flexible work benefits.

As coworking operators continue to develop their signature product sets and scale new solutions to improve their occupiers’ working conditions, Acclime Vietnam found that more multi-national companies (MNCs) who have been present in Vietnam with just a few key people have the tendency to choose flexible workspace operators, solving this way one of their major problems: the relatively high price and limited availability in the traditional workspace sector.

Alex Crane, Managing Director of Knight Frank Vietnam, said flexible space in Vietnam is not only an important tool for corporate occupiers looking at more hybrid-driven workplace models but also for the growth of Vietnam’s impressive start-up scene.

“We expect the entrepreneurial nature of the Vietnamese population to continue to underpin the need for great flexible space and this, of course, will be supplemented by multinational corporations who are continuing to both expand in and arrive as new market entrants to Vietnam,” he added.

Daan van Rossum, CEO of FlexOS and Dreamplex saw that companies will become more like coworking space operators. Their offices will have a wide range of working spaces that are not assigned to anyone but freely available to use. So that when an employee comes in, they have the tools to do their best work.

“Because when young Vietnamese can work from anywhere, they need a clear and compelling reason to work from the office,” he said.