Social housing supply exceeds targets in 2025 as Vietnam tackles property imbalances

Vietnam surpassed its social housing construction target in 2025, marking progress in housing policy, but supply mismatches, high prices and legal bottlenecks continue to weigh on the real estate market.

THE HANOI TIMES — Vietnam completed more than 102,630 social housing units in 2025, slightly exceeding the annual target and marking solid progress toward the goal of building at least one million social housing units by 2030.

The figure surpassed the full-year target of 100,275 units set for 2025. During the year, authorities launched 90 new social housing projects, adding a total supply of 95,630 units, according to Nguyen Van Sinh, Deputy Minister of Construction.

A social housing building in Ha Dong Ward, Hanoi. Photo: Thu Giang/The Hanoi Times

Overall, the number of social housing units completed, launched and approved between 2021 and 2025 reached 62% of the national target for the 2021–2030 period.

By the end of December 2025, nearly 700 social housing projects were under development nationwide, with a total scale exceeding 657,400 units. Of these, 193 projects had been completed, delivering about 169,000 units, while another 200 projects had broken ground and remained under construction, with a combined scale of roughly 134,100 units.

Nineteen localities met or exceeded their assigned social housing targets, including Hanoi, Ho Chi Minh City, Haiphong, Danang, Hue, Cantho, Bac Ninh, Thai Nguyen, Nghe An, Phu Tho and Ca Mau.

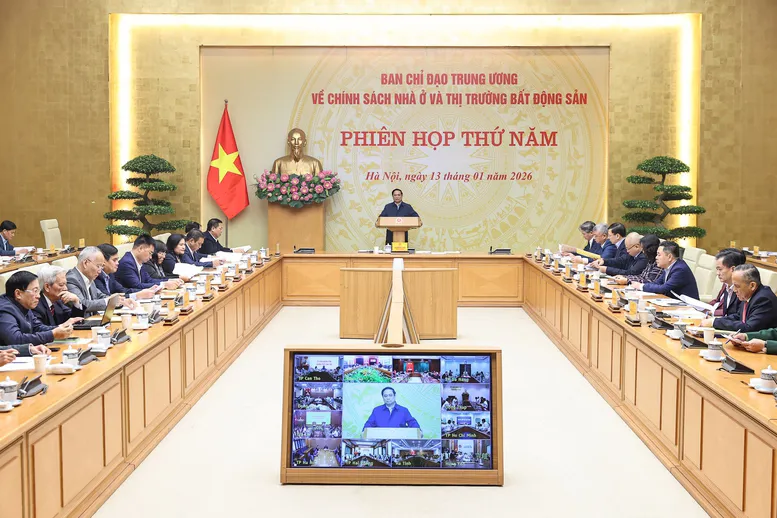

Reporting to the fifth meeting of the Central Steering Committee on Housing Policy and the Real Estate Market on January 13, Sinh said authorities had accelerated efforts to eliminate temporary and dilapidated housing, surpassing the original timeline by more than five years.

Central ministries and local governments have also rolled out the Quang Trung campaign to repair and rebuild homes damaged by recent natural disasters, with completion expected by mid-January 2026.

Beyond social housing, Vietnam currently has more than 2,100 commercial housing and urban development projects and nearly 700 social housing projects nationwide. Authorities have completed 68 infrastructure projects and are implementing 548 others to enable land-use rights transfers for households to build homes.

Nationwide, authorities have approved investment policies for 428 commercial housing projects with total capital of about VND3.8 quadrillion (US$144.6 billion). Among these, 93 projects received new construction permits covering nearly 37,700 units, while 88 projects have been completed, providing about 29,900 units.

Primary market data show that the real estate market remained subdued in 2020 and 2021, with just over 280,000 transactions per year. From 2022 to 2025, the market gradually recovered, with annual transactions rising to between 537,000 and 785,000. In 2025 alone, more than 580,400 successful transactions were recorded nationwide.

Housing prices and residential land values continued to rise year by year. Apartments, townhouses, villas and residential land recorded the strongest increases, averaging 10% to 15% annually, with some periods reaching 30%. In contrast, tourism, resort, commercial, office and industrial real estate prices rose more moderately, at about 5% to 10% per year.

Local reports show that inventories of apartments, individual houses and land plots all increased compared with the third quarter of 2025. Apartment and individual housing inventories reached about 138% of third-quarter levels, while land plot inventory stood at roughly 109%.

Sinh attributed these imbalances to supply concentrating mainly in mid-range and high-end segments, while affordable housing remains scarce, particularly for industrial workers, low-income households and social housing beneficiaries.

Legal bottlenecks have also delayed many projects despite large capital investment, wasting land and financial resources, raising costs and pushing sale prices higher, he said.

Several localities have shown limited initiative in managing housing supply structures and land reserves, while paying insufficient attention to social housing and affordable commercial housing.

According to the State Bank of Vietnam, outstanding real estate credit has continued to rise. As of August 31, 2025, total real estate credit stood at about VND4.1 quadrillion (US$156 billion).

Prime Minister Pham Minh Chinh delivers his speech at the fifth meeting of the Central Steering Committee on Housing Policy and the Real Estate Market on January 13. Photo: VGP

Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association, said recent years, especially 2025, exposed clear supply shortages, mismatched supply and demand, high prices and persistent legal obstacles.

Although housing supply has recovered to near pre-2020 levels, its structure remains weak, with about 35% land plots and 65% apartment units. Within the apartment segment, affordable housing has nearly disappeared, while mid-range, high-end and luxury units dominate, driving prices higher, he said.

To ease pressure, Dinh called for the development of a professional rental housing market. Limited rental supply has increased ownership pressure, pushed demand and prices upward and encouraged speculative activity.

Authorities should prioritize worker housing projects with reasonable prices to reduce ownership pressure and stabilize the market, while continuing to expand social housing and affordable commercial housing, he said.

Nguyen Si Dung, former Vice Chairman of the Office of the National Assembly, identified the core problem as a structural imbalance between supply and demand, especially in affordable and mid-priced segments.

Developers concentrate on high-end projects because institutional, procedural and time-related costs remain high, leaving little room for profit in lower-priced housing, he said.

Rather than relying on heavy administrative intervention, Dung urged authorities to reduce institutional costs, ensure legal certainty for public officials and create stronger incentives for developers to build affordable housing.

Vietnam should focus on removing regulatory barriers instead of maintaining complex two-price mechanisms that strain administrative resources, he added.

Supply-demand balance, data sharing as keys

To address these challenges, Sinh said the Ministry of Construction will prioritize reviewing and refining housing and real estate regulations in 2026.

The ministry plans to accelerate administrative reform, simplify construction investment procedures, strengthen decentralization under the two-tier local government model and apply digital transformation to improve market oversight.

Sinh said the ministry will continue urging localities to implement the National Housing Development Strategy for 2021–2030, with a vision to 2045, based on actual demand and planning.

Housing development will move in parallel with urban renewal while ensuring synchronized technical and social infrastructure.

The ministry will adjust supply structures to help bring housing prices closer to levels aligned with household affordability.

Sinh reaffirmed the commitment to completing the one-million-unit social housing program, while promoting affordable commercial housing, rental and rent-to-own models.

The fifth meeting of the Central Steering Committee on Housing Policy and the Real Estate Market on January 13. Photo: VGP

The Ministry of Construction will also establish a National Housing Fund to manage, invest in and operate housing resources, continue eliminating substandard housing and safeguard citizens’ right to shelter.

In parallel, authorities will complete national data systems covering housing, real estate markets, land, construction, planning, taxation and finance to improve transparency and data sharing.

Prime Minister Pham Minh Chinh reaffirmed that housing is an essential need and that policies must ensure equal access.

Authorities must bring commercial housing prices, especially apartments, back to reasonable levels in line with national development, he said, adding that housing policy must place people at the center.

The Prime Minister assigned the Ministry of Finance to review tax policies to curb speculation and price manipulation while directing capital toward productive activities.

He tasked the State Bank of Vietnam with tightening control over real estate credit to prevent speculative flows from distorting the market and to manage lending risks.

He also asked the Ministry of Construction to develop housing policies for middle-income earners with monthly incomes above VND20 million.

Local governments must review demand for rental social housing and housing for civil servants, he said, noting that social housing projects, especially rental units, will receive priority treatment in administrative procedures.