Hanoi office market in Q4/2019 sees launch of only Grade B buildings

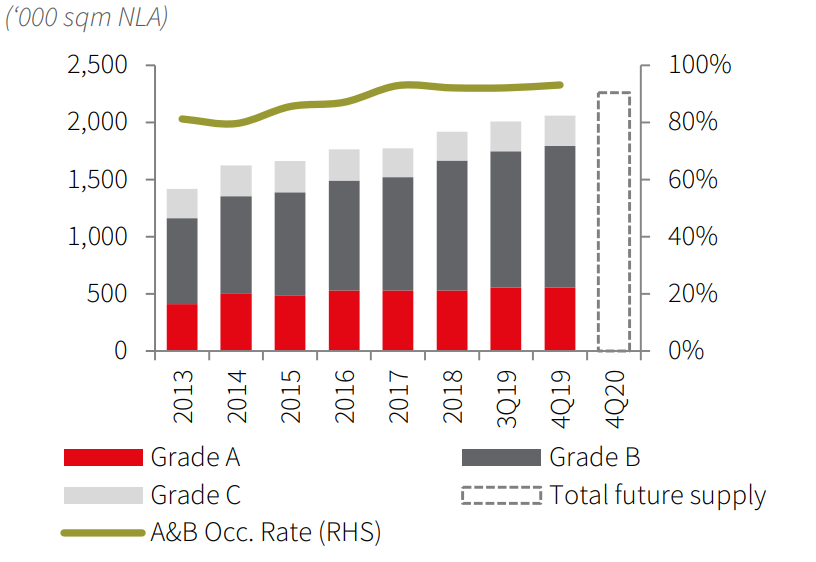

The new launch drives up the total supply of Grade B segment to 1.8 million square meters.

Only Grade B buildings joined Hanoi’s office market in the fourth quarter (Q4) of 2019, totaling the supply of this segment to almost 1.8 million square meters (sq.m).

Two new buildings namely Coninco Tower and Peakview Tower were located in Dong Da District, one of the main office clusters of Hanoi, JLL said in a recent report, giving no additional figure.

However, the leading professional services firm in real estate and investment management said with high construction quality and reasonable prices, the two buildings achieved an impressive occupancy rate in the first quarter of opening.

According to JLL, Dong Da also welcomed the largest amount of new supply in 2019.

| Hanoi's total office supply. Chart: JLL |

In the quarter, demand for both Grade A and B submarkets remained stable which was recorded via a higher net absorption from that in the previous quarter, the report showed.

Meanwhile, the occupancy rate of the market continued to increase and reached 93.0%, in which Grade A submarket posted the rate of 94.0%.

The net absorption of Grade A offices was positive, mainly attributed to TNR Tower and ThaiHoldings Tower, the two latest additions to the market. Meanwhile, Grade B buildings recorded higher net absorption than Grade A due to its abundant supply.

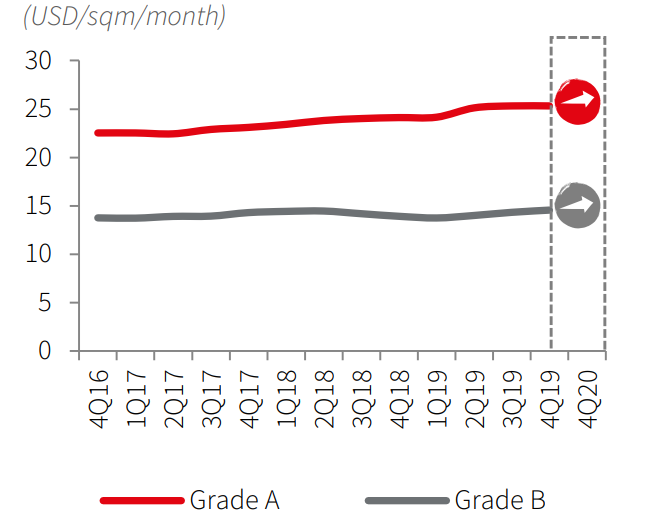

| Office average rents. Chart: JLL |

In terms of rental, the average rate of both Grade A and B office increased moderately by 0.3% on year during Q4, it leads to a considerable growth of 6% on year, JLL said, noting that positive demand helped sustain the growth throughout 2019, however, the pace started to show signs of weakening toward the year-end period.

By location, during 2019, central business district (CBD) area, in which Dong Da district took the lead, rose faster than the new office clusters including Cau Giay and Nam Tu Liem districts since the majority of supply was located in central areas. In addition, the new additions in the CBD area with high quality also benefited the trend.

Accordingly, JLL said the market is expected to welcome a large amount of new supply in both Grade A and B in 2020, of which Capital Place is the most notable one as it might set new standards for the office market, based on its first-class quality.

Demand is believed to stay steady, with relocation and expansion being the main drivers. However, with a large supply pipeline, landlords should employ a flexible strategy to quickly react to the changes in the market and tenants’ needs, JLL emphasized.