Vietnam leads top choice for global investors: Cushman & Wakefield

Vietnam is considered an attractive investment destination and a dynamic, open economy with a high growth rate in the world.

Vietnam has been the top choice for global investors in terms of office and industrial sectors in the Asia Pacific, according to Cushman & Wakefield.

| Vietnam is considered an attractive investment destination. Photo: Pham Hung/ The Hanoi Times |

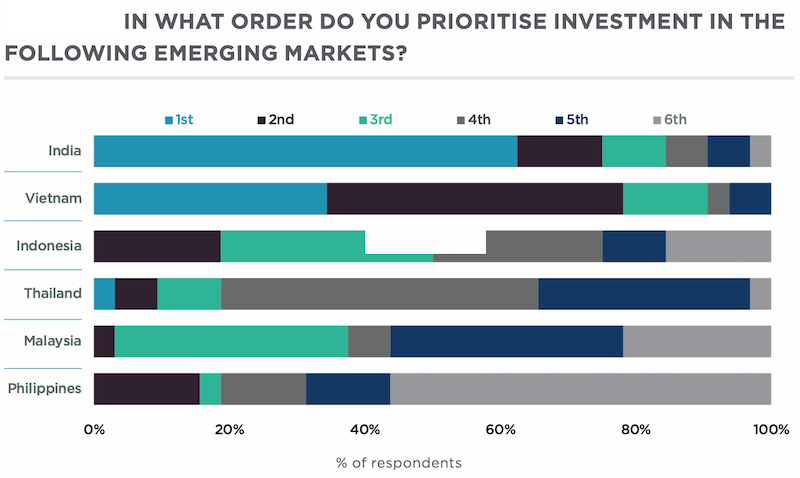

The latest survey conducted by the global real estate services firm showed India was ranked by just over 60% of respondents as their preferred emerging market (excluding mainland China) in which to invest. On a first- and second-place preferred basis, Vietnam was the emerging market of choice, taking almost 80% of the votes, just ahead of India’s 75%.

Trang Bui, CEO of Cushman & Wakefield Vietnam, said: “To attract more FDI [foreign direct investment] into the country, Vietnam is focusing investments in upgrading important transportation facilities like highways and seaports and increasing competition index ranking. These upgrades are contributing to robust growth in the economy and especially in the logistics and industrial sector.”

She added, that the Ministry of Transport has planned to complete the North-South Expressway, the 1st phase of Long Thanh International Airport, Quang Ninh - Kien Giang coastal road, and metro lines in both the North and the South. Thanks to the efforts over the years, Vietnam is considered an attractive investment destination and a dynamic, open economy with a high growth rate in the world.

Investors are having to “look laterally” to find opportunities for growth in the current market but can still successfully deploy capital, experts say, as ongoing uncertainty in the macroeconomic environment slows early-year momentum.

Representatives from leading investment houses said rising interest rates and an inflationary environment had caused a ‘pause’ in the market as investors re-weighted their portfolios within the current conditions.

“Despite the slowdown, investor sentiment was leaning towards a cautious resumption of deal flow to the Asia Pacific later in 2022 once global players from the US and Europe had adjusted to the current conditions,” said Regional Director, APAC Capital Markets at Cushman & Wakefield Gordon Marsden.

| Source: Cushman & Wakefield |

When asked how they would split US$1 billion across different sectors, investors voted to allocate more to logistics than to office, with a significant additional allocation to alternatives including data centers – a sector with solid tailwinds under-supplied - and multifamily. Despite softening yields, over 35% believed the logistics sector remains fundamentally undersupplied, with a further 30% expecting positive but slower growth within the sector.

The focus on industrial and logistics was particularly evident in Greater China, where it was the largest sector by investment volume in Hong Kong SAR in the first six months of 2022. In mainland China, industrial/logistics is currently the second-largest sector by investment volume, accounting for approximately 25% of the total investments in the first half of this year - up from around 10% in 2020 and 2021, and only 2% in 2019, according to Cushman & Wakefield data.

Diversification within the living sector was also evident as compressed yields forced investors to think more strategically and look beyond traditional multifamily properties for growth. In Japan, the aging population was identified as a demographic tailwind for senior living accommodation while strong policy support prompted another investment firm to focus its attention on the childcare industry in Australia.

“The rising significance of the living sector should not be underestimated. Diversity within the sector allows for different investment strategies. Furthermore, the frequent lease renewal opportunities can act as a hedge against inflation, providing a blend of near-term inflation protection and longer-term growth opportunities,” said Dr. Dominic Brown, Head of Insight and Analysis, APAC at Cushman & Wakefield.

As investors adjust to the higher interest rate environment, Marsden added, there was an evident move away from more opportunistic strategies.

“Just over 50% of investors indicated that they considered the best risk/return today to be in value-add Tier 1 opportunity,” he said, and added emerging economies placed second with just under 20% of the vote.

In the first six months of 2022, Vietnam recorded a new FDI high with US$10.06 billion in capital from foreign investors being disbursed. This is the highest disbursement rate in the past five years. Real estate accounted for 26% of total capital with leading investors from Singapore, Japan, Denmark, China, and South Korea.

“Investors are seeking after industrial and logistics properties, development land, hotels, and offices,” Trang said.

Despite the more cautious approach, Marsden expects sectors and markets in the Asia Pacific with strong fundamentals to continue attracting attention from local and global investors.

“Investors who are focusing on the long-term in sectors and markets that are fundamentally under-supplied and/or have solid tailwinds are less concerned about the current volatility. They are having to search harder for opportunities, but they are still there," he said.