Vietnam set to be ASEAN’s fastest growing economy in 2022

The country’s positive outlook is bucking the slowing trend of the region.

Vietnam continues to be a highlight of the regional economy as its GDP growth is expected to be the fastest in Southeast Asia at 7-7.5% in 2022, posing a stark contrast to the grim outlook of the region and the world, according to the International Monetary Fund (IMF) and Standard Chartered Bank.

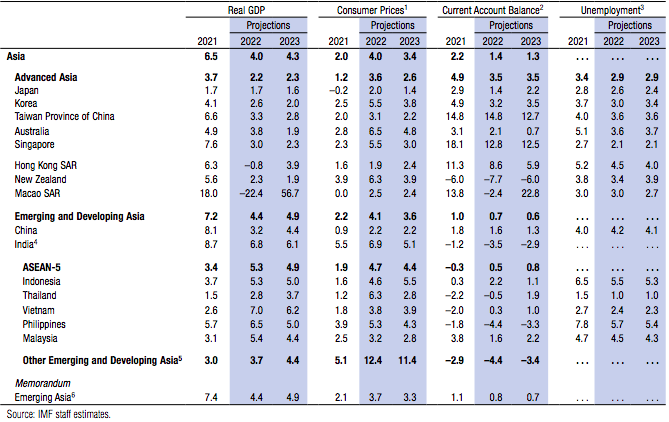

| IMF's economic forecast for Asian and Pacific economies. |

The IMF, in its latest World Economic Outlook – titled “Countering the Cost-of-Living crisis”, projected the average growth of the ASEAN-5 (including Vietnam, Indonesia, Malaysia, the Philippines, and Thailand) at 5.3% this year, before slowing down to 4.9% in 2023.

Such modest growth, however, remains much higher than the estimated GDP growth of Asia, at 4%, lower than the 6.5% growth in 2021. This was the fourth time the IMF downgraded the growth forecast for the region amid turbulent challenges experienced by the global economy.

In this context, global growth is forecast to slow from 6% in 2021 to 3.2% in 2022 and 2.7% in 2023.

“This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the Covid-19 pandemic and reflects significant slowdowns for the largest economies: a US GDP contraction in the first half of 2022, a euro area contraction in the second half of 2022, and prolonged Covid-19 outbreaks and lockdowns in China with a growing property sector crisis,” stated the IMF, noting about a third of the world economy faces two consecutive quarters of negative growth.

According to the IMF, inflation was higher than seen in several decades, tightening financial conditions in most regions, the Russia-Ukraine conflict, and the lingering Covid-19 pandemic all weigh heavily on the outlook.

Normalization of monetary and fiscal policies that delivered unprecedented support during the pandemic is cooling demand as policymakers aim to lower inflation back to target. But a growing share of economies are in a growth slowdown or outright contraction

IMF suggested the global economy’s future health rests critically on the successful calibration of monetary policy, the course of the war in Ukraine, and the possibility of further pandemic-related supply-side disruptions, for example, in China.

Inflation as threat to Vietnam's recovery

Standard Chartered Bank gave a more positive forecast for Vietnam's GDP growth in 2022 at 7.5%, and moderate to 7.2% in 2023.

While the lender lowers its inflation forecast for this year to 3.3% from 4.2%, it expects an acceleration in Q4 to 5% from 3.3% in Q3. Inflation has been largely under control and price pressures may increase in the rest of 2022 and in 2023. In addition to supply-side factors, demand-side factors might kick in more strongly.

Tim Leelahaphan, Economist for Thailand and Vietnam at Standard Chartered Bank, said: “We maintain our average 2023 inflation forecast at 5.5%, expecting it to rise throughout next year, reaching around 6% late next year. We see inflation as a threat to Vietnam’s continued recovery.”

Standard Chartered’s economists expected the State Bank of Vietnam (SBV) to continue tightening monetary policy and forecast a 50bps [basis points] hike in the refinancing rate each in Q4 2022 and Q1 2023, taking the rate to 6%, following a 100bps hike to 5% on September 22.

Leelahaphan added: “We see a risk of SBV raising rates more than we expect if inflation accelerates and the Vietnamese dong (VND) weakening more than we forecast as the Fed maintains a relatively hawkish stance. We expect SBV to stay vigilant against inflation and financial instability besides helping businesses recover from the Covid-19 impact.”

The UK-based lender said the VND is likely to face several headwinds in the short term - a hawkish Fed, strong USD, higher commodity prices, and slowing external demand. The VND continues to significantly outperform its peers across emerging markets in Asia, despite recent depreciation.

The bank expects the pace of VND depreciation to slow in the coming months. USD-VND’s correlation with USD-CNY remains extremely strong. As such, a peak in USD-CNY will likely coincide with a peak in USD-VND.

The lender forecasts USD-VND at 24,200 by end-2022 and at 24,000 for end-Q1-2023 and declining towards 23,400 by end-2023.