Vietnam unveils special tax incentives for International Financial Center

The move is seen as an important step to strengthen competitiveness, attract capital, high-quality talent and international financial institutions to Vietnam.

THE HANOI TIMES — Vietnam has introduced a package of special tax and financial incentives aimed at attracting foreign investment and high-skilled professionals to its International Financial Center (IFC), according to a newly-issued government decree.

Under Decree No. 324/2025/ND-CP, projects operating within the IFC will benefit from preferential corporate and personal income tax policies, marking one of the most generous incentive schemes Vietnam has offered for the financial sector to date.

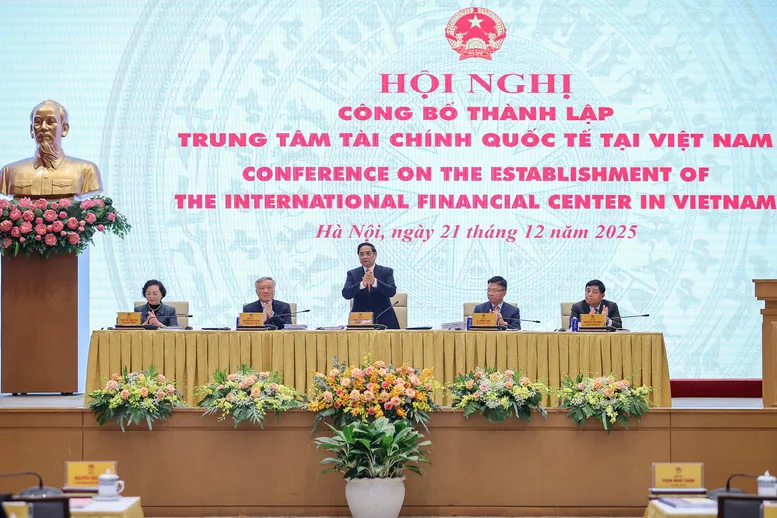

Prime Minister Pham Minh Chinh and other government's senior officials during the confernece on the establishment of the International Financial Center on December 21. Photo: VGP

Priority projects in key sectors will be eligible for a 10% corporate income tax rate for 30 years, along with a four-year tax exemption and a 50% tax reduction for the following nine years.

Projects outside priority sectors are subject to a 15% tax rate for 15 years, combined with a tax exemption of up to two years and a 50% reduction for up to the next four years. Enterprises may choose the most favorable incentive scheme if they qualify for multiple incentive schemes under the law.

In addition, managers, experts, scientists and highly-skilled workers, both Vietnamese and foreign, working at the IFC will be exempt from personal income tax on salaries and wages until the end of 2030.

Income from the transfer of shares, capital contributions or capital contribution rights in member entities of the International Financial Center is also exempt from personal income tax over the same period, except for transfers of listed securities governed by current regulations.

The incentives are designed to support the development of a modern financial ecosystem, covering banking, securities, insurance and other financial services, while encouraging innovation and international participation.

The decree provides implementation guidance for National Assembly Resolution No. 222/2025/QH15, which laid the legal foundation for establishing the International Financial Center and its associated policy framework.

According to the drafting agency, these tax incentives are expected to create a more attractive investment environment aligned with international standards while helping build a modern financial ecosystem, strengthen capital market development and enhance Vietnam’s position in regional and global financial value chains.