Profits of Vietnam’s stock market predicted to stay flat in 2020

It is expected the Vietnamese stock market will be less volatile in March compared to the previous months.

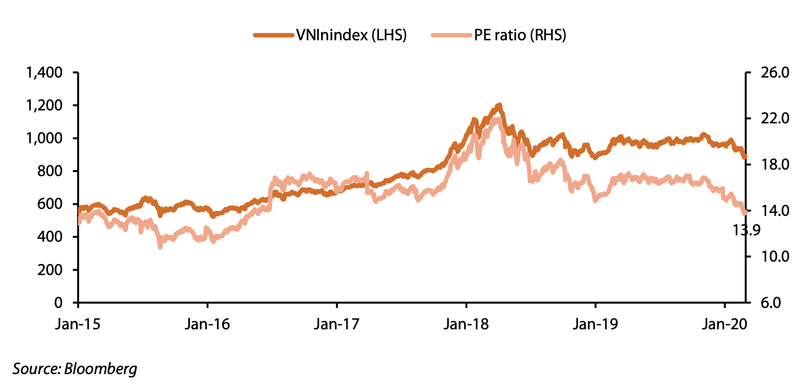

With price to earnings (P/E) forward of the benchmark VN-Index at 13.9x, just slightly higher than the current PE of 13.85x, Vietnam’s stock market is expecting profits to be almost flat in 2020, according to Viet Dragon Securities Company (VDSC).

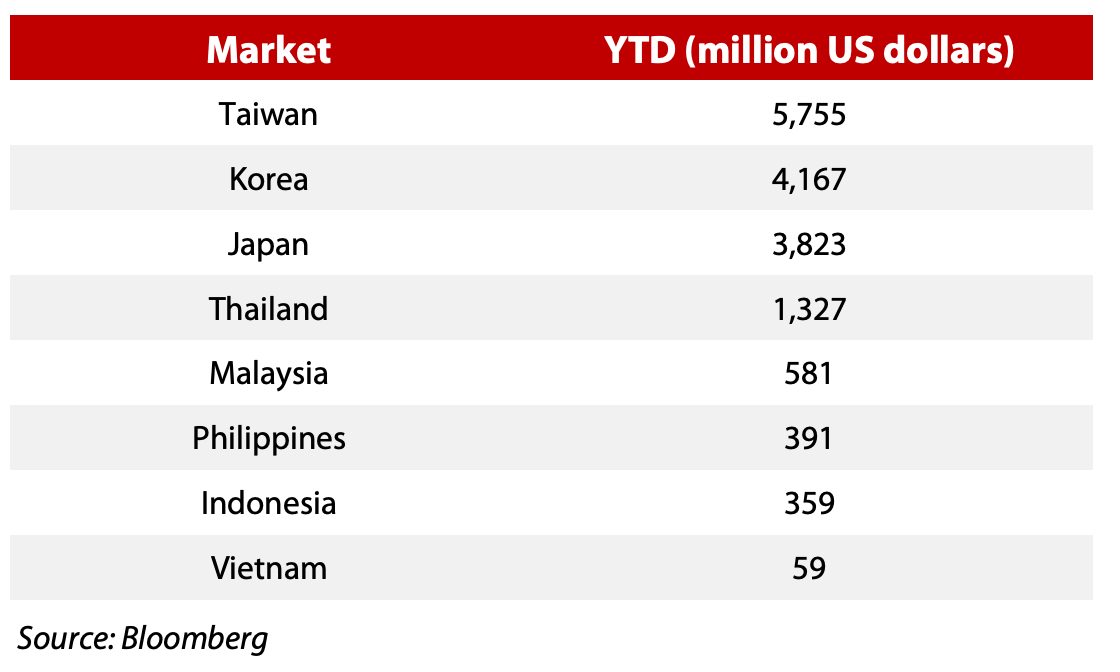

| Foreign investor net selling value by market. |

Therefore, preliminary earning results for the first quarter of 2020 and business plans for the rest of the year will have a significant impact on the market, said the brokerage in its monthly report.

Market sentiment is affected by both the Covid-19 epidemic and the net selling of foreign investors. Since the Lunar New Year, eight out of 22 sessions have fluctuated by more than 1% and the average daily trading value has increased by more than 30% compared to the figure before the Lunar New Year holiday or Tet.

Before the Lunar New Year holiday, foreign investors net bought VND630 billion (US$27.32 million), but they turned to be net sellers coinciding with the spreading of the Covid-19 outbreak in China.

| Current P/E of Vn-index. |

However, foreigners are net sellers not only in Vietnam, but also in most other Asian markets. The probability that foreign investors continue to sell is quite high. VDSC expected foreign investors to stop selling alltogether or switch to net buying will only happen when the epidemic situation is under control and the Vietnam authorities issue policies to support the economy.

It is expected the Vietnamese stock market will be less volatile in March compared to the previous months, said the VDSC analysts.

This is due to (1) the market has partly reflected the impact of Covid-19, and (2) the support from the government will help stabilize the market.

VDSC forecasts the range of the benchmark Vn-Index will stay between 880 and 925.

The VN-Index dropped 5.8% to 839.85 as of the break on March 9 morning.

The State Bank of Vietnam (SBV), the country’s central bank, has requested commercial banks to review and create accommodations for affected businesses.

Meanwhile, the government in coordination with commercial banks, has just announced a VND250 trillion (US$10.86 billion) credit support package with low interest rates and a support package from fiscal policy of at least VND30 trillion (US$1.3 billion).

On top of that, VDSC said the ability to resume the supply chain of raw materials for the activities of the textile, footwear, electrical and electronics industries will be important. Currently Vietnam's raw material supply to such sectors comes from China, accounting for more than 30% of total.

The country's abilities to control of the disease and the restoration of business operations are matters of high priority, said VDSC report.