Easing legal conditions to boost supply in Vietnam’s condominium market

The outlook is decidedly bullish for Vietnam’s residential market in the long term.

It is expected that the overall supply in the condominium market in Vietnam will slightly improve thanks to the easing of legal conditions, but the sales price growth will be lower than in 2019, according to Viet Dragon Securities Company (VDSC).

Besides, many developers are also shifting their focus to other neighboring markets to capture the upgrade of infrastructure projects as well as compensate for the shortages in Hanoi and Ho Chi Minh City. Rapid price increases in neighboring provinces have fueled fears about the sustainability of the trend and the health of the property market. Some local authorities have therefore tightened the new launches in the past few months to cool down the market and step up efforts to clamp down on speculative buying.

In 2019, the market was driven by the launches of large-scale projects from Vinhomes, the residential property developer of Vingroup. In terms of condominium transaction volume, during the first nine months of 2019, Hanoi and Ho Chi Minh City saw increases of 22% and 5% year-on-year, respectively. On the other hand, excluding three large projects from Vinhomes, the residential sector in these cities remained relatively bleak due to cumbersome legal processes. Demand was still good with a high absorption rate. Sales prices in the condominium segment increased by an average of 15-20% compared to the end of 2018, led by a decrease in supply.

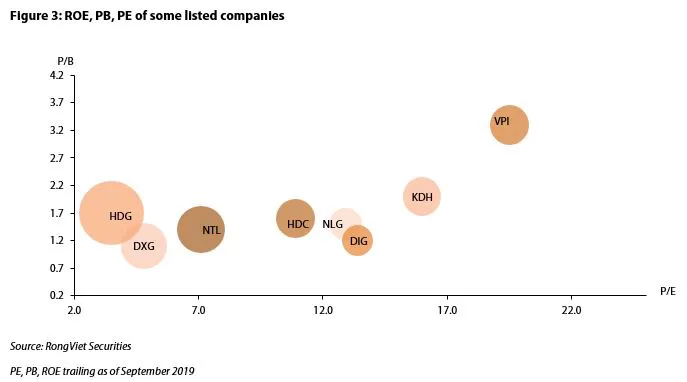

The outlook is decidedly bullish for Vietnam’s residential market in the long term. Developers are very active in accumulating land bank to catch up with this trend, especially in suburban provinces. However, it is expected that only projects located in central business districts such as Hanoi or Ho Chi Minh City cities will achieve high absorption rates, and the prospect for tier-2 and 3 provinces will face headwinds. Accordingly, the developers possessing available land bank in key cites will benefit from this trend.