FTSE Russell pledges support for Vietnam’s upgrade to emerging market status

Prime Minister Chinh urged FTSE Russell to continue supporting Vietnam in achieving emerging market status and developing a transparent, efficient, and sustainable stock market that conforms to global standards.

THE HANOI TIMES — FTSE Russell will help Vietnam upgrade its stock market classification from frontier to emerging market, according to Gerald Toledano, the firm’s Global Head of Equity and Multi Asset.

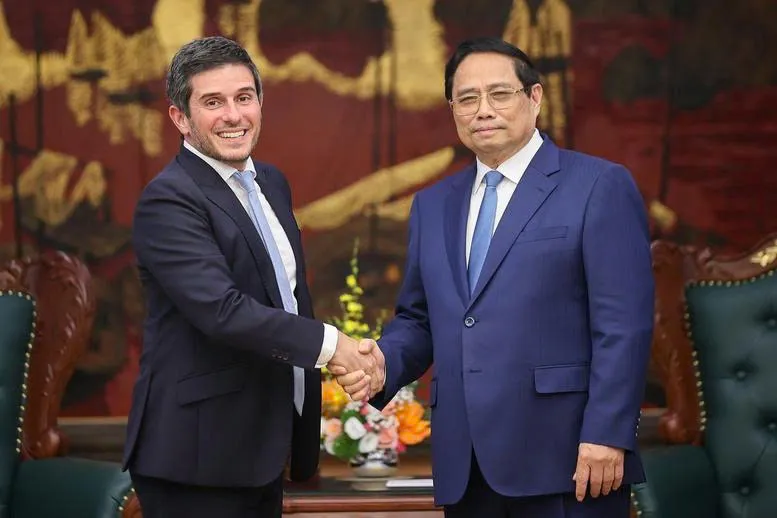

Toledano told Prime Minister Pham Minh Chinh at a meeting on July 17 that the company, which is part of the London Stock Exchange Group (LSEG), will also share Vietnam’s reform progress with global investors.

Prime Minister Pham Minh Chinh (right) meets Gerald Toledano, FTSE Russell’s Global Head of Equity and Multi Asset, on July 17. Photo: VGP

Toledano praised Vietnam’s commitment and determination and the reform measures it has undertaken to develop its financial market. These measures include developing a roadmap for implementing a central counterparty clearing mechanism.

These reforms will help develop the Vietnamese economy in the right direction and are key criteria in FTSE Russell’s market classification assessments.

Toledano said he was impressed by Vietnam’s stock market liquidity and noted that it is now the most liquid market in ASEAN.

For his part, Prime Minister Pham Minh Chinh welcomed FTSE Russell’s objective monitoring and assessment of Vietnam’s economy and stock market.

He also appreciated the firm's valuable recommendations and solutions.

According to Chinh, the Vietnamese economy is in transition as modest in size and highly open, vulnerable to external shocks.

The country aims for a minimum GDP growth rate of 8% in 2025 and double-digit growth between 2026 and 2030.

The government is committed to maintaining macroeconomic stability, controlling inflation, and ensuring key economic balances.

“As our demand for capital is very high, developing a highly efficient capital market is an urgent task to mobilize private resources in the private sector,” he said.

Vietnam has made its investment environment more transparent and business-friendly, pledged to protect the legitimate rights and interests of investors, and passed an amended Securities Law. Additionally, Vietnam has planned to develop an international financial center.

Prime Minister Chinh called on FTSE Russell to continue assisting Vietnam in achieving emerging market status and in building a transparent, efficient, and sustainable stock market that meets international standards.

He requested the firm’s support in developing legal frameworks, modern infrastructure, smart governance, and human resource training; operating the international financial center; and attracting global investors.

The meeting was part of a working visit by Gerald Toledano and other senior FTSE Russell officials to learn more about Vietnam’s capital market and review its classification status.

According to FTSE Russell’s latest review conducted in March 2025, Vietnam remains on the watch list for an upgrade to secondary emerging market status. The Vietnamese stock market has been on the watch list since September 2018.

FTSE Russell currently assesses 47 countries and their stock markets, covering 90% of the global market. The firm provides indexes used by 94 of the world’s top 100 asset managers, who have nearly $16 trillion in assets under management.

Market classification reviews are published every March and September, outlining which countries have been upgraded, downgraded, or placed on the watch list.