How has Vietnam's property evolved over last 25 years

Besides being considered the sector of choice for investors in Vietnam, property remains the safest and most effective investment channel.

Since the mid-90s, the domestic property market has had a pattern of impressive growth, brief downturn and recovery. However, the Covid-19 pandemic in the first half of 2020 negatively affected the market in an unprecedented manner. On the occasion of Savills Vietnam’s 25th anniversary, Neil MacGregor, managing director of Savills Vietnam, looks back at the property market and the developing economy over his own 20 years in Vietnam.

| Neil MacGregor, managing director of Savills Vietnam. Photo: Savills |

1995 to 1998

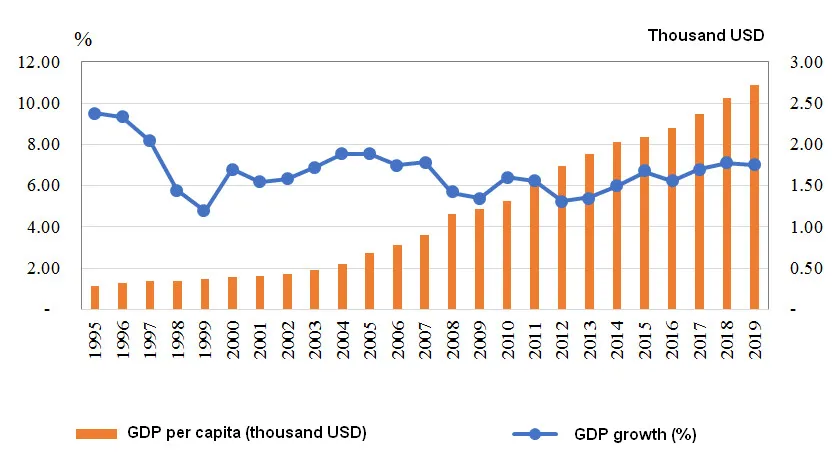

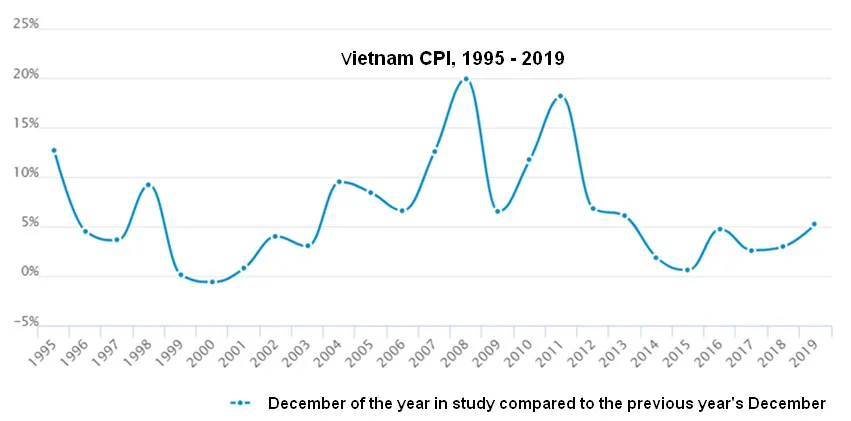

Stabilizing relations with the United States and officially joining ASEAN in 1995 marked successful milestones. The transition from centrally planned to a market driven economy was establishing a robust platform for lasting change and growth. The General Statistics Office shows growth in 1995 was 9.54%, and 9.34% in 1996, correlating with per capita Gross Domestic Product (GDP) increasing from US$277 in 1995, to US$324 in 1996. Inflation was reined in from 12.7% in 1995 to 4.5% in 1996 and 3.6% in 1997.

At the same time, GDP growth and increased consumer confidence resulted in rising land prices, as the property market started to show signs of promise. The domestic market then entered a prolonged slowdown with the onset of the Asian Financial Crisis in 1998 impacting the nascent market economy. General Statistics Office data shows 5.76% economic growth in 1998 while inflation reached 9.2%. However, the limited market opening resulted in a proactive government response which helped successfully manage the crisis and enable a strong foundation for future growth.

1998 to 2008

The early years of the 21st century were characterized by further economic integration. In 2001, the Vietnam – US Bilateral Trade Agreement (BTA) was ratified followed in 2006 by Vietnam becoming a member of the World Trade Organization (WTO). Back in 2000, Vietnam was considered the next ‘Asian Tiger’ economy with per capita GDP growing to US$396, compared to US$328 in Laos and US$283 in Cambodia.

New national economic and macroeconomic policies saw 6.79% GDP growth in 2000, up to 6.89% in 2001, followed by robust GDP growth averaging 8.23% p.a from 2004 to 2007. Property market fluctuations inevitably followed. National economic indicators reflected a strong global economy, increased confidence in local economic recovery and steady increases of foreign direct capital (FDI).

Furthermore, effective government policies contributing to market performance saw land prices ramping up. Significant price growth driven by increasing transactions led to the property market becoming everyone’s favorite investment channel. However, land prices increasing significantly over the two most frantic periods of 2001 to 2003, and 2007 through 2008, started to exclude lower-income investor participation from Ho Chi Minh City and Hanoi.

Vietnam: Per capita GDP and GDP growth, 1995 – 2019. Source: General Statistics Office |

2008 to 2018

Growth punctuated by slowdown continued. In mid-2008, effects from the Global Financial Crisis (GFC) led to a downward cycle in the domestic property market and land prices dropped by up to 40%. Property inventory in 2012 was over VND100,000 billion (around US$5 billion), while property enterprises under bad debt increased.

Rapidly rising inflation forced the State Bank of Vietnam to tighten monetary policies. The Government, by revising policies and releasing economic stimulus packages to attract investment, helped successfully navigate the crisis.

Social housing-focused companies helped responsibly modify social housing policies and pricing. Together with the government-supported VND30 trillion credit packages, a real estate recovery started but inventory remained high. The market started to demonstrate sustained growth. Property segments bursting into life such as Hotels and Second Homes ushered in new economic potential for provinces gifted with favourable geography and natural appeals such as Ba Ria-Vung Tau, Phu Quoc island, Nha Trang, Halong and in particular Danang.

Vietnam CPI, 1995 - 2019. Source: General Statistics Office |

2018 to 2020

The latest World Bank report finds Vietnamese economic growth over the last 2 years has been mainly driven by high consumer demand and manufacturing-based export growth. Economic data indicating 7% real GDP growth in 2019, reflected one of the fastest growing economies in the region. While globalization has positively affected Vietnam, the Covid-19 pandemic has caused extensive damage to global and local economies.

Fortunately, early and decisive measures from the government meant Vietnam was far less affected than other countries in the region. While fiscal policies were stable with GDP growth reaching 3.8% in Q1/2020, the pandemic, as it expanded became more unpredictable.

The Asian Development Bank (ADB) estimates that Vietnam's GDP growth will reach 4.1% in 2020. Although this is 0.7 percentage points lower than their forecast in April, it remains the highest forecast growth in SE Asia. The World Bank anticipates 3% GDP growth in 2020, and its 6.8% growth forecast for 2021 shows confidence remains high in the local economy. The Vietnamese economy is primed for the recovery and the real estate sector is set to be one of the key beneficiaries in 2021 and beyond.

Mr. Neil MacGregor has been with Savills Vietnam since 2001, after beginning his real estate career in the UK. With first-hand experience of Vietnam’s rapid growth in the last 20 years and as Savills Managing Director since 2012, he has led Savills Vietnam through the highs and lows of the property market.

Even when the entire economy was affected by pandemic, his outlook for Vietnam remained positive, while his informed position gives him high confidence in the domestic property market recovery. “Vietnam has retained exceptional growth, despite being affected by various economic crises over the last 25 years. And besides being considered the sector of choice for investors in Vietnam, property remains the safest and most effective investment channel. Even though Covid-19 might last into early 2021, we anticipate a strong recovery from 2021 to 2022 and beyond. Moreover, effective, and timely Government support, as shown through its effective pandemic response and recent stimulus policies, will provide further powerful leverage for real estate businesses and the national economy.”