Connectivity to bolster Vietnam’s integration in global markets: WB

There is a growing need to better integrate and connect domestic markets to ensure that any potential slowdown in exports can be offset by higher domestic demand.

Developing quality connective infrastructure and logistics is crucial to lower trade costs and boost Vietnam’s further integration in both global and domestic markets, which requires a new approach to planning and additional investments in strategic connective assets, a new World Bank report has suggested.

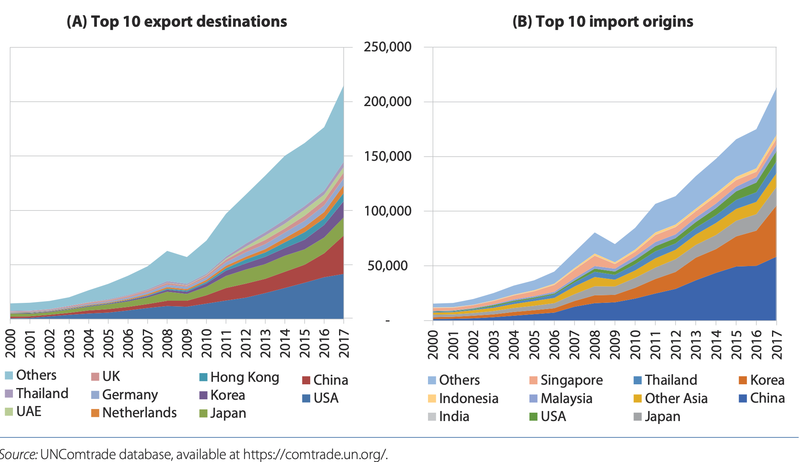

| Vietnam’s trade growth trajectory by trade partners. |

“The rapidly changing patterns of international trade and domestic consumption coupled with increasing natural disaster risks will have implications on Vietnam’s future connectivity needs,” said Ousmane Dione, World Bank country director for Vietnam, at the launch of the bank's Vietnam Development Report, titled “Connecting Vietnam for Growth and Shared Prosperity” on January 15.

“Upgrading connectivity, not just physical infrastructure but also transportation and logistics services, with the right policies and investments will help Vietnam go a long way towards achieving deeper integration, promoting inclusion and building resilience,” added Dione.

While Vietnam’s main engine of growth has been exports, driven mainly by FDI and integration into global value chains, there is a growing need to better integrate and connect domestic markets to ensure continued growth and shared prosperity and also to ensure that any potential slowdown in exports can be offset by higher domestic demand, Dione continued.

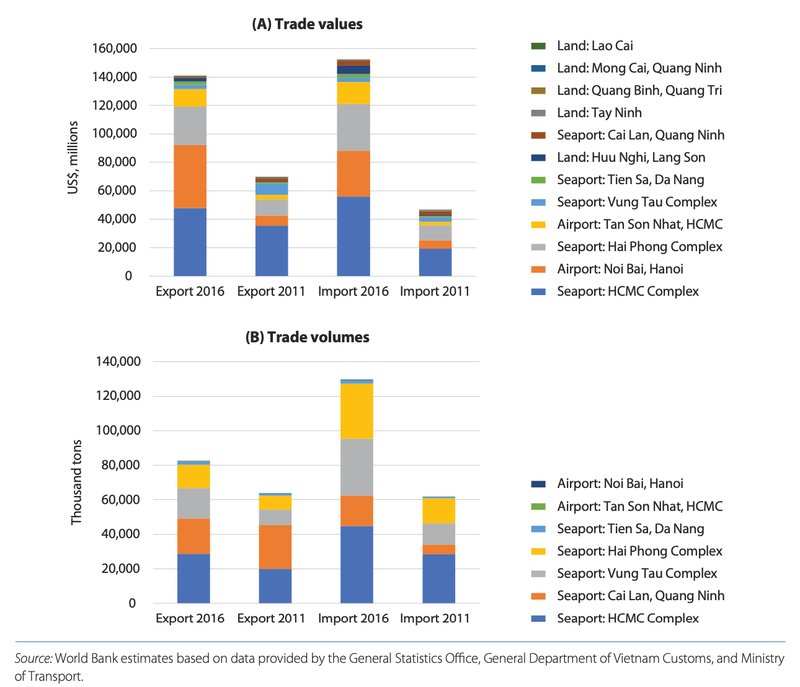

The report finds the uneven development of transport infrastructure across the country, capacity bottlenecks at major gateways, and a major imbalance in supply and demand. The country’s trade flows are concentrated at one quarter of total border gates—two airports, five seaports and five border-crossing points—which collectively handled 86% the value of total trade in 2016. As trade grows, so does congestion around these international gateways and border-crossing points.

| Vietnam’s trade at its major border gates in 2011 and 2016. |

Within the country, the movement of goods is conducted mainly on the road network, which carries three-quarters of total cargo volumes. Vietnam’s extensive network of natural waterways is under-utilized because its ports and landing stages are ill-suited to accommodate larger volumes of cargo. The use of container-based cargo, which enables efficient intermodal transfers, is relatively limited. Meanwhile, Vietnam’s 2,600-km railway network remains stuck at a low state of development.

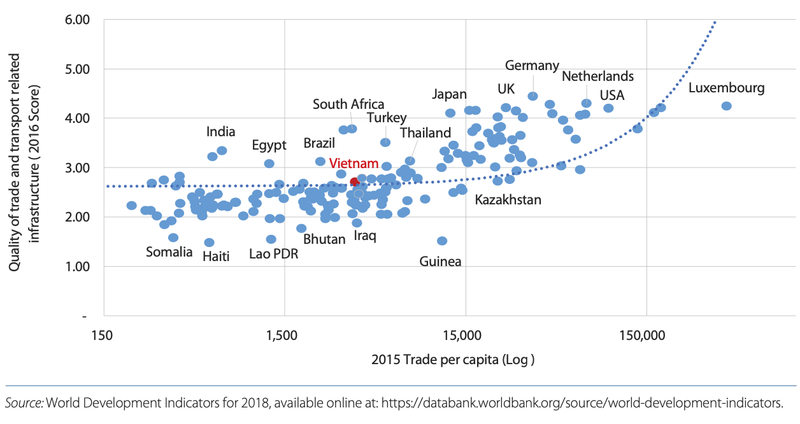

| Quality of trade-related infrastructure versus trade per capita. |

The report highlights the steps Vietnam can take to address the fragmented state of connectivity to better facilitate international trade.

Reconfigure the network of international gateways by bringing a network perspective in planning and developing gateways, moving away from the current decentralized planning.

Re-orient transport and spatial planning to support critical value chains by creating a new ecosystem of trade and transport links that will be critical to facilitating supply chains, the movement of inputs and final products.

Create “economic densities” along new corridors by encouraging development of the land surrounding high-value transport nodes for high productivity activities.

The report proposes key measures to develop transport and logistics services to better integrate domestic markets.

Upgrade connectivity “software” by creating an enabling regulatory environment and providing financial incentives to support the growth of logistics service providers and promoting the adoption of technology.

Overhaul market infrastructure and logistics in cities by mainstreaming spatial planning of market infrastructure and logistics facilities into future urban planning.

The report also suggests solutions to improve the resilience and reliability of the transport system and deliver on “last-mile” inclusion in lagging areas with better connectivity.